Please note: Lending options, rates, and qualifications change regularly. The information in this post is based off of requirements as of original posting date of July 2, 2024.

Obtaining a $100,000 business loan marks a notable milestone, and our guide aims to support you through the journey. Choosing the right loan is key, given that each financing avenue has specific requirements.

As with all types of lending, you need to reach different requirements with the proper Fundability in order to fully qualify. This article is giving you the information you need to understand the starting points for some of the most common types of funding available. Additionally, it’s important to keep maximum approval amounts in mind when searching for funding. You will find each one we touch on in this article have a wide range of maximum limits. But with the correct combination, you have the possibility to reach those funding needs and wants much easier.

The table below has the requirements for each major business loan type.

The Best $100k Business Loans

| Loan Type | Requirements | Approval Difficulty |

| Bank Loan (Term Loan) | Good credit, 2 years in business, business cash flow | Hard |

| Business Line of Credit | Good credit, 2 years in business, business cash flow | Hard |

| SBA Loan | Good credit, 2 years in business, business cash flow | Hard |

| Credit Line Hybrid | Good credit | Easy (No Doc) |

| Business Credit Card | Good credit | Easy |

| Equipment Financing | Good credit | Easy |

| Merchant Cash Advance | Credit card sales, bad credit | Easy |

| Cash Flow Financing | Business cash flow, fair credit | Easy |

How to Qualify for a $100,000 Business Loan

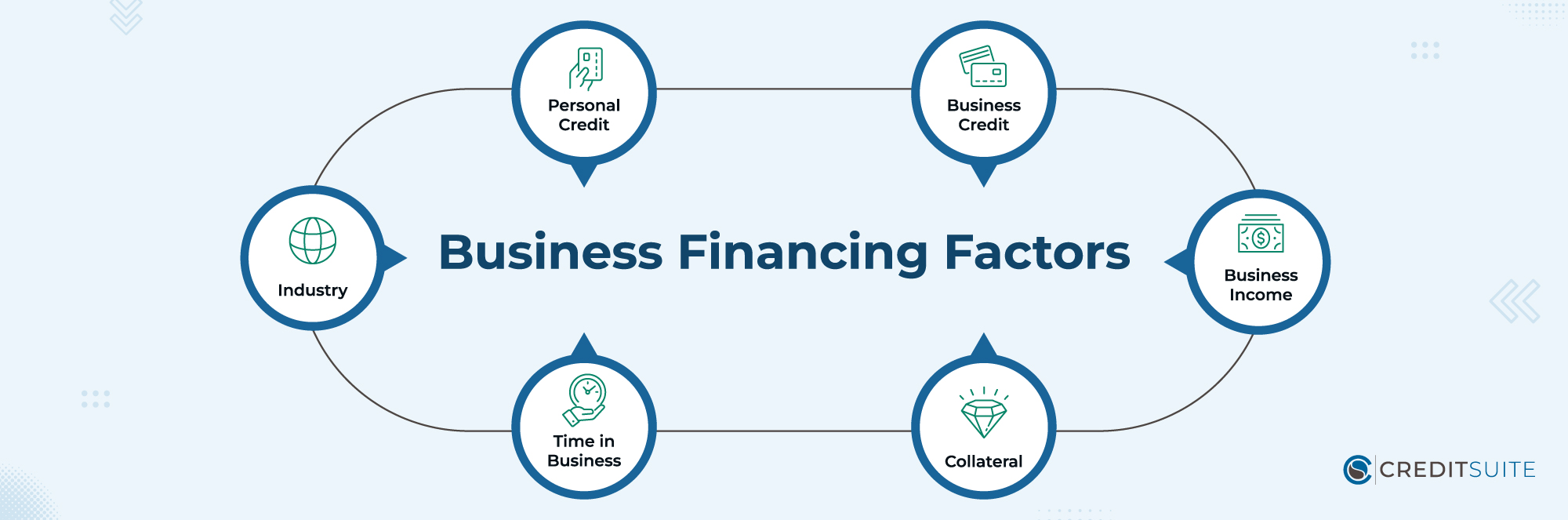

Securing approval for a business loan relies on six key factors. Traditional bank loans require proficiency in each of these aspects, while alternative financing avenues might provide more leeway. These factors include:

- Personal Credit: Many lending institutions that cater to small businesses require the business owner to uphold favorable personal credit standings.

- Business Credit: Having robust business credit scores and comprehensive reports can streamline the process of qualifying for a loan.

- Business Income: Most business financing options mandate validation of revenue in some capacity.

- Collateral: Acquiring approval for loans backed by assets, such as car loans, mortgages on business properties, and equipment financing, typically comes with smoother processes.

- Time in Business: Commercial lenders often prefer observing a business track record of at least two to three years.

- Industry: Despite having strong financial standings, some sectors encounter difficulties in obtaining approval.

The Best $100k Business Loan Types

Bank Loans (Term Loans)

Business loans from conventional banks are commonly referred to as term financing. This entails making consistent payments over a predetermined “term,” typically lasting 3 to 5 years. Such loans typically come with stable interest rates.

Requirements: To secure bank term loans, entrepreneurs typically require a robust personal credit record (FICO Scores exceeding 680), a business in operation for a minimum of two years, and yearly revenues totaling at least $100,000.

Business Line of Credit

Business credit lines, like term loans, are often extended by traditional banks. Though they boast enticing interest rates, meeting the eligibility criteria can be a hurdle.

Upon approval, you gain access to a loan resembling a credit card, facilitating repeated usage. A credit limit is set, for instance, at $100,000, and you’re required to make gradual payments to settle the debt.

Requirements: To be eligible for business lines of credit, small business owners usually need a solid personal credit history (FICO Scores over 680), at least two years of business operation, and annual revenues of more than $100,000.

SBA Loans

Integrating standard bank backing with governmental assistance, SBA Loans provide advantageous terms and reduced interest rates. However, obtaining approval for these loans might pose challenges.

Several SBA loan categories are available, with the 7a and 504 loans being among the most common selections.

Requirements: SBA loans vary in their prerequisites, but as a general rule, they demand a history of operation (typically at least one year), favorable personal credit scores, and a specific amount of business income.

Credit Line Hybrid

Credit Suite presents a unique opportunity with its Credit Line Hybrid, offering rapid approval for business loans ranging from $10,000 to $150,000 without the need for extensive documentation.

Requirements: To qualify for the Credit Line Hybrid, a good personal credit score (FICO 680+) is needed. New businesses without history, collateral, or strong cash flow can still apply, making it easier.

Business Credit Cards

Business credit cards offer an additional avenue for financing with straightforward eligibility requirements. Similar to personal credit cards, they provide access to a credit line, which is then repaid monthly.

The key difference between business and personal cards is that the higher credit limits are typically offered by the former. Additionally, building business credit enables entrepreneurs to access these cards without solely depending on their personal credit background.

Requirements: Business credit cards typically require a robust personal credit background, with potential consideration of business revenue in certain instances.

Equipment Financing

Acquiring equipment financing offers a smoother route to eligibility than alternative avenues. This entails securing either a loan or a lease agreement with fixed monthly installments for acquiring heavy machinery or equipment.

Should you need a $100,000 loan for equipment procurement, this avenue deserves careful consideration.

Requirements: In equipment financing, maintaining a robust personal credit background is crucial, along with your willingness to actively engage in the process.

Merchant Cash Advance

Merchant cash advances operate on a business’s “merchant processing” infrastructure, which manages credit card transactions. In this arrangement, the creditworthiness of the business owner and other variables have little impact.

Once the funds are received, repayment is automated through deductions from sales, eliminating the need for fixed payment schedules.

Given their high financing costs, these advances should only be considered as a last resort if other funding options are available to the business owner.

Requirements: A steady flow of monthly revenue through credit card transactions, preferably surpassing $10,000, is preferred. Less-than-perfect credit is considered acceptable.

Cash Flow Financing

Acknowledging the constraints of merchant cash advances, Credit Suite provides a superior alternative known as Cash Flow Financing. Similar to merchant cash advances, eligibility for this financing primarily relies on a business’s cash flow.

Yet, unlike merchant cash advances, Cash Flow Financing doesn’t confine qualification to businesses reliant solely on credit card sales; it evaluates all forms of cash flow.

Requirements: Strong cash flow, at least $10,000 per month. Below average credit scores accepted.

Looking for another loan amount? Consider these articles: $900k Business Loan Options, $800k Business Loan Options, $700k Business Loan Options, $600k Business Loan Options, $500k Business Loan Options, $400k Business Loan Options, $300k Business Loan Options, $250k Business Loan Options, $200k Business Loan Options, and $150k Business Loan Options.