Please note: Lending options, rates, and qualifications change regularly. The information in this post is based off of requirements as of original posting date of Jul 2, 2024.

Achieving the milestone of obtaining a $300,000 business loan marks a notable accomplishment, and our guide stands ready to offer support throughout the process. Choosing the right loan is paramount since each financing option has its own specific requirements.

As with all types of lending, you need to reach different requirements with the proper Fundability in order to fully qualify. This article is giving you the information you need to understand the starting points for some of the most common types of funding available. Additionally, it’s important to keep maximum approval amounts in mind when searching for funding. You will find each one we touch on in this article have a wide range of maximum limits. But with the correct combination, you have the possibility to reach those funding needs and wants much easier.

The table below has the requirements for each major business loan type.

The Best $300k Business Loans

| Loan Type | Requirements | Approval Difficulty |

| Bank Loan (Term Loan) | Good credit, 2 years in business, business cash flow | Hard |

| Business Line of Credit | Good credit, 2 years in business, business cash flow | Hard |

| SBA Loan | Good credit, 2 years in business, business cash flow | Hard |

| Credit Line Hybrid | Good credit | Easy (No Doc) |

| Business Credit Card | Good credit | Easy |

| Equipment Financing | Good credit | Easy |

| Merchant Cash Advance | Credit card sales, bad credit | Easy |

| Cash Flow Financing | Business cash flow, fair credit | Easy |

How to Qualify for a $300,000 Business Loan

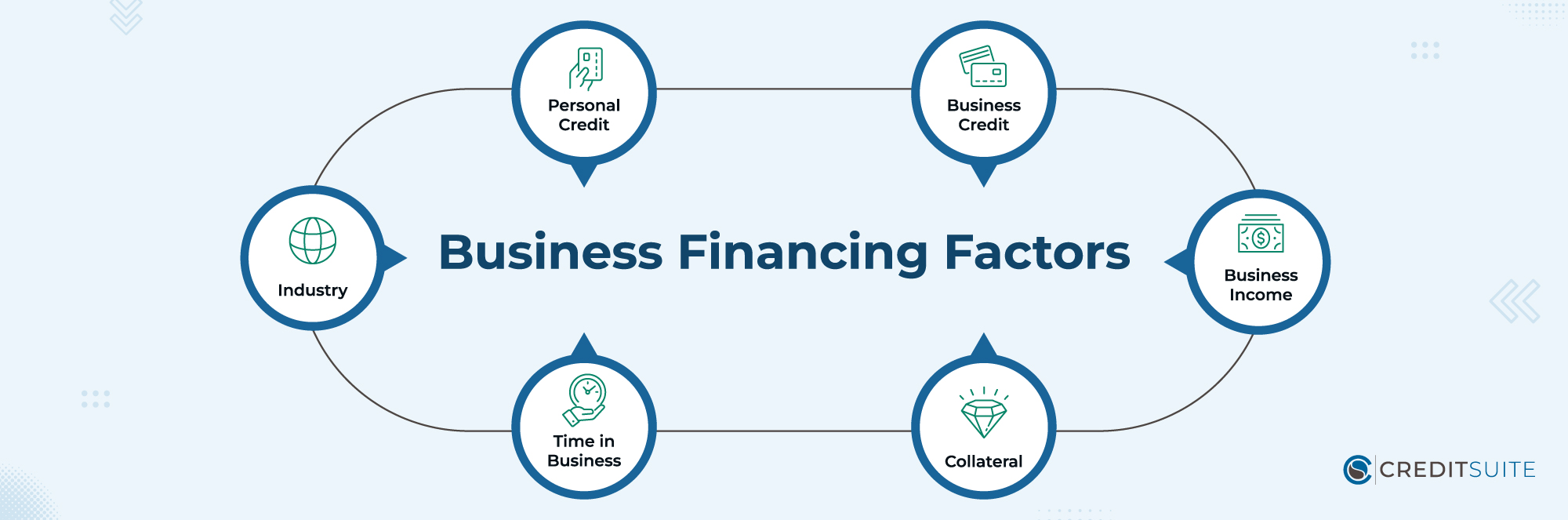

Securing approval for a business loan hinges on six crucial factors. Traditional bank loans necessitate proficiency in all these aspects, while alternative financing paths might present more leeway. These key elements encompass:

- Personal Credit: Many specialized lenders that cater to small businesses often expect entrepreneurs to uphold robust personal credit ratings.

- Business Credit: Developing strong business credit scores and detailed profiles can simplify the process of qualifying for a loan.

- Business Income: In the world of business finance, most approaches to securing funds typically demand proof of revenue as an initial prerequisite.

- Collateral: Obtaining approval for asset-backed loans, such as vehicle financing, commercial property mortgages, and equipment loans, typically involves simplified processes.

- Time in Business: Most corporate lending entities typically favor engaging with businesses that have a track record spanning two to three years.

- Industry: Even with a solid economic foundation, certain sectors may encounter difficulties in securing approval.

The Best $300k Business Loan Types

Bank Loans (Term Loans)

Commercial lending through mainstream banks is often known as term financing. It entails making regular payments over a specified “term,” typically ranging from 3 to 5 years. Such funding typically comes with fixed interest rates.

Requirements: To qualify for bank term financing, entrepreneurs typically require a strong personal credit record (with FICO Scores exceeding 680), a business in operation for a minimum of two years, and yearly revenues of at least $100,000.

Business Line of Credit

Securing approval for business credit lines, akin to term loans, is commonly provided by traditional banks. While the interest rates may be appealing, the eligibility requirements can be rigorous.

Once granted, you acquire a loan that operates much like a credit card, offering versatility for various purposes. A predetermined credit limit, let’s say $300,000, is allocated, and gradual repayments are required to clear the outstanding balance.

Requirements: In order to qualify for business credit lines, small business proprietors usually require a robust personal credit history (FICO Scores surpassing 680), a minimum of two years of business operations, and yearly profits surpassing $100,000.

SBA Loans

By blending the backing of conventional banks with government assurances, SBA Loans provide advantageous conditions and reduced interest rates. Nevertheless, navigating the approval procedure for these loans can pose challenges.

A range of SBA loan options are available, with the 7a and 504 loans emerging as the favored choices.

Requirements: To qualify for SBA loans, businesses frequently need to demonstrate one year of operational history, robust personal creditworthiness, and meet certain revenue benchmarks.

Credit Line Hybrid

Credit Suite presents a groundbreaking option called the Credit Line Hybrid, ensuring quick approval for business financing ranging from $10,000 to $150,000, with minimal documentation needed.

Requirements: The Credit Line Hybrid necessitates a respectable personal credit score (FICO 680 or above). It’s open to startups without a history, collateral, or substantial cash flow, simplifying the application process.

Business Credit Cards

Business credit cards provide another avenue for financial assistance, boasting simple eligibility criteria. Operating much like personal credit cards, they extend a line of credit necessitating monthly repayment.

The primary distinction between corporate and individual credit cards lies in the typically higher credit limits linked with the former. Additionally, building a credit history for the business enables entrepreneurs to obtain these cards without solely relying on their personal credit histories.

Requirements: Typically, business credit cards require a solid personal credit background, and occasionally, they may also evaluate the company’s revenue.

Equipment Financing

Obtaining equipment financing offers a more straightforward path to eligibility compared to other options.

This entails setting up either a loan or lease with consistent monthly payments to acquire machinery or heavy equipment. If you’re seeking financing, especially a $300,000 loan for equipment acquisition, this option deserves thorough consideration.

Requirements: In contemplating equipment financing, it’s essential to possess a strong personal credit background and a genuine willingness to actively participate in the process.

Merchant Cash Advance

Utilizing a company’s “merchant processing” system, merchant cash advances manage credit card transactions. In this arrangement, the creditworthiness of the business owner and additional factors are of lesser importance.

Once funds are received, repayment is automatic, with a portion of sales deducted, removing the need for fixed payment schedules.

Considering their higher financing expenses, these advances should be regarded as a last resort when other funding options are available to the business owner.

Requirements: A consistent monthly revenue from credit card transactions, preferably exceeding $10,000, is highly sought after. In this scenario, less-than-perfect credit is considered acceptable.

Cash Flow Financing

Acknowledging the constraints associated with merchant cash advances, Credit Suite introduces a beneficial substitute known as Cash Flow Financing. Like merchant cash advances, the main prerequisite for this financing option is the business’s cash flow.

Nevertheless, Cash Flow Financing distinguishes itself from merchant cash advances by not limiting eligibility only to companies depending on credit card transactions for income. Instead, it assesses all sources of cash flow.

Requirements: Strong cash flow, at least $10,000 per month. Below average credit scores accepted.

Looking for another loan amount? Consider these articles: $900k Business Loan Options, $800k Business Loan Options, $700k Business Loan Options, $600k Business Loan Options, $500k Business Loan Options, $400k Business Loan Options, $250k Business Loan Options, $200k Business Loan Options, $150k Business Loan Options, and $100k Business Loan Options.