Please note: Lending options, rates, and qualifications change regularly. The information in this post is based off of requirements as of original posting date of July 2, 2024.

Securing a $30,000 business loan can be quite challenging, but our guide will outline the steps to achieve it. Since each business loan and financial product comes with unique criteria, selecting the appropriate loan is crucial.

As with all types of lending, you need to reach different requirements with the proper Fundability in order to fully qualify. This article is giving you the information you need to understand the starting points for some of the most common types of funding available. Additionally, it’s important to keep maximum approval amounts in mind when searching for funding. You will find each one we touch on in this article have a wide range of maximum limits. But with the correct combination, you have the possibility to reach those funding needs and wants much easier.

The table below has the requirements for each major business loan type.

The Best $30k Business Loans

| Loan Type | Requirements | Approval Difficulty |

| Bank Loan (Term Loan) | Good credit, 2 years in business, business cash flow | Hard |

| Business Line of Credit | Good credit, 2 years in business, business cash flow | Hard |

| SBA Loan | Good credit, 2 years in business, business cash flow | Hard |

| Credit Line Hybrid | Good credit | Easy (No Doc) |

| Business Credit Card | Good credit | Easy |

| Equipment Financing | Good credit | Easy |

| Merchant Cash Advance | Credit card sales, bad credit | Easy |

| Cash Flow Financing | Business cash flow, fair credit | Easy |

How to Qualify for a $30,000 Business Loan

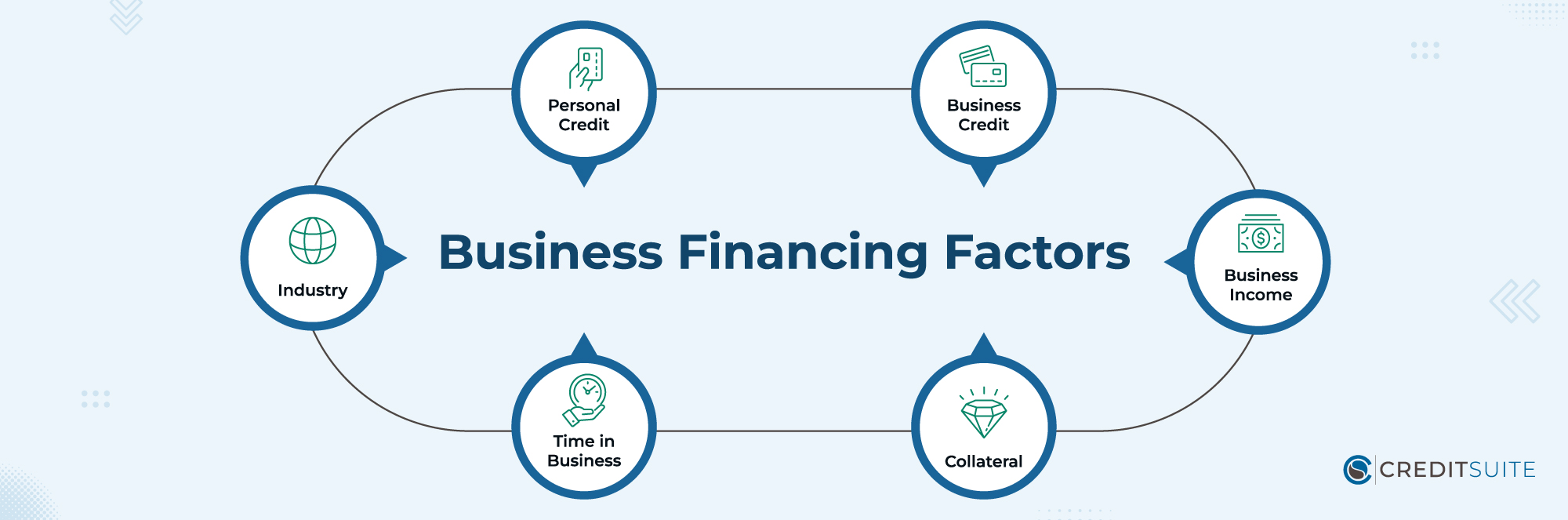

Qualifying for a business loan involves six main factors. To secure traditional bank financing, you must meet the criteria for all of them. (Other financing options may be more flexible.) These factors include:

- Personal Credit: Many lenders for small businesses expect the business owner to possess favorable personal credit scores.

- Business Credit: Solid business credit scores and reports can streamline the process of securing loans.

- Business Income: Demonstrating some form of income is typically necessary for most varieties of business financing.

- Collateral: Securing approval for collateral-based loans, like vehicle loans, commercial mortgage loans, and equipment financing, tends to be much simpler.

- Time in Business: Several business lenders prefer to observe a minimum of 2 or 3 years of operational history.

- Industry: Certain sectors may encounter challenges in obtaining approval, irrespective of their financial strength.

The Best $30k Business Loan Types

Bank Loans (Term Loans)

Traditional bank loans for businesses, known as term loans, involve regular payments over a fixed period, typically 3 to 5 years, with fixed interest rates.

Requirements: Typically, bank term loans necessitate a small business owner with a solid personal credit history (FICO Scores of 680+), a minimum of two years in operation, and annual revenue exceeding $100,000.

SBA Loans

SBA Loans, backed by the government, offer favorable terms and lower interest rates, akin to traditional bank loans. However, qualifying for them can be challenging.

Various types of SBA loans exist, with 7a loans and 504 loans being among the most prevalent options.

Requirements: Each SBA loan has unique requirements, but typically they demand at least one year in business, good personal credit scores, and some business revenue.

Business Line of Credit

Similar to term loans, business lines of credit are commonly provided by mainstream banks. Although they offer low-interest rates, qualifying for them can be challenging.

With a business line of credit, you gain access to a revolving loan, akin to a credit card. You’re assigned a credit limit, say $30,000, from which you can repeatedly draw funds. Subsequently, you’re required to make minimum payments over time to settle the balance.

Requirements: Business lines of credit generally require the small business owner to have good personal credit (680+ FICO Scores), 2+ years in business, and $100,000+ in annual revenue.

Credit Line Hybrid

Credit Suite offers the Credit Line Hybrid, a unique product with funding from $10,000 to $130,000, providing quick approval without documentation.

Requirements: The Credit Line Hybrid necessitates favorable personal credit scores (FICO Score of 680+). Startups with no operational history, no collateral, and limited cash flow are encouraged to apply. Qualifying for the Credit Line Hybrid is comparatively straightforward.

Business Credit Cards

Another option for financing is business credit cards, which offer straightforward qualifications. They operate similarly to personal credit cards, providing a credit limit for immediate access, followed by gradual monthly repayments.

The primary contrast between business and personal credit cards lies in their higher credit limits for business cards. Additionally, by establishing business credit, even small business owners can become eligible for them without relying on their personal credit history.

Requirements: To qualify for business credit cards, you generally need a solid personal credit history. While some may also consider business revenue, it’s not a requirement for all cards.

Equipment Financing

Equipment financing presents another option that’s simpler to qualify for. This entails either a loan or lease with consistent monthly payments to acquire substantial equipment or machinery.

If you’re in need of a $30,000 business loan for equipment procurement, consider exploring this avenue first.

Requirements: To secure equipment financing, it’s essential to have a strong personal credit history and a willingness to commit.

Merchant Cash Advance

Merchant cash advances leverage a business’s credit card sales through its “merchant processing” system. The credit scores of business owners and other factors play a minor role in this process.

After receiving funding, the borrower repays the debt automatically over time, with repayments based on a percentage of sales. As a result, there are no set payments.

Given their high financing costs, it’s advisable to steer clear of merchant cash advances if alternative financing options are available to business owners.

Requirements: Substantial monthly credit card sales, typically no less than $10,000. Poor credit accepted.

Cash Flow Financing

Recognizing the constraints of merchant cash advances, Credit Suite introduces an enhanced solution – Cash Flow Financing. Similar to a merchant cash advance, eligibility for this financing hinges mainly on a business’s cash flow.

However, unlike restricting financing to businesses with credit card sales, Cash Flow Financing considers all forms of cash flow for qualification.

Requirements: Strong cash flow, at least $10,000 per month. Below-average credit scores accepted.

Looking for another loan amount? Consider these articles: $40k Business Loan Options, $50k Business Loan Options, $60k Business Loan Options, $70k Business Loan Options, $80k Business Loan Options, $90k Business Loan Options, and $100k Business Loan Options.