Please note: Lending options, rates, and qualifications change regularly. The information in this post is based off of requirements as of original posting date of July 2, 2024.

Getting a $50k business loan is no small feat, but our article will show you how to do it. Each business loan and financing product has different requirements, so picking the right loan is half the battle.

As with all types of lending, you need to reach different requirements with the proper Fundability in order to fully qualify. This article is giving you the information you need to understand the starting points for some of the most common types of funding available. Additionally, it’s important to keep maximum approval amounts in mind when searching for funding. You will find each one we touch on in this article have a wide range of maximum limits. But with the correct combination, you have the possibility to reach those funding needs and wants much easier.

The table below has the requirements for each major business loan type.

The Best $50k Business Loans

| Loan Type | Requirements | Approval Difficulty |

| Bank Loan (Term Loan) | Good credit, 2 years in business, business cash flow | Hard |

| Business Line of Credit | Good credit, 2 years in business, business cash flow | Hard |

| SBA Loan | Good credit, 2 years in business, business cash flow | Hard |

| Credit Line Hybrid | Good credit | Easy (No Doc) |

| Business Credit Card | Good credit | Easy |

| Equipment Financing | Good credit | Easy |

| Merchant Cash Advance | Credit card sales, bad credit | Easy |

| Cash Flow Financing | Business cash flow, fair credit | Easy |

How to Qualify for a $50,000 Business Loan

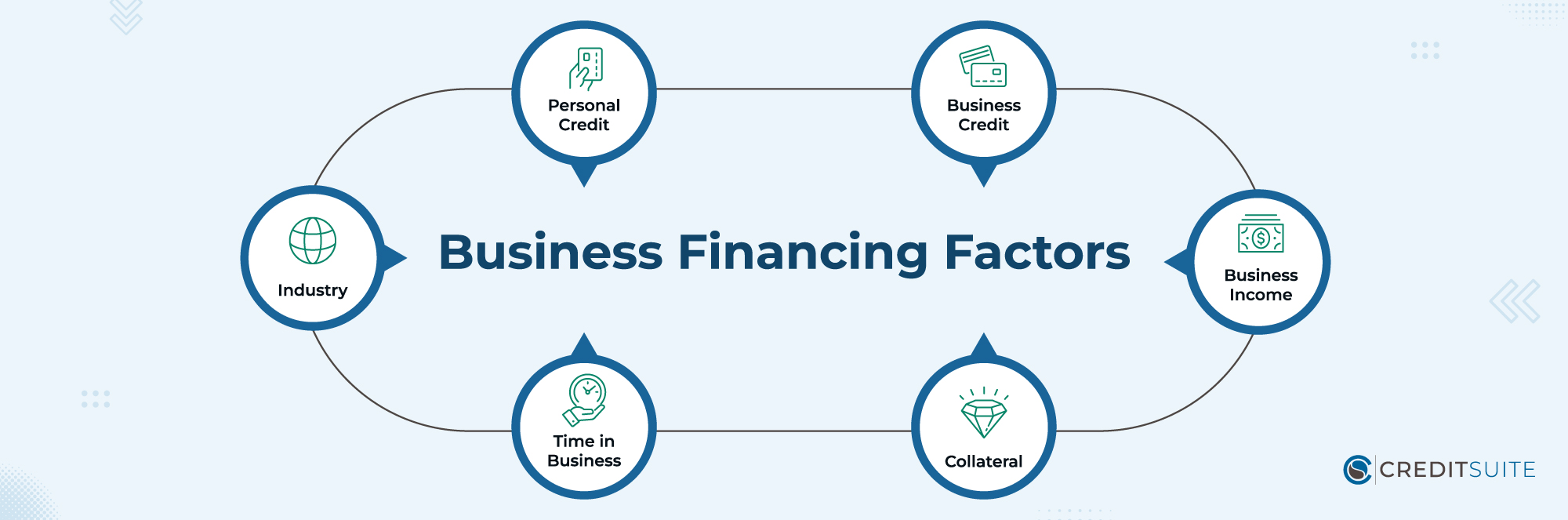

There are six major components to qualifying for a business loan. You need to score well on all of them to qualify for traditional bank financing. (Other types of financing are more lenient.) They are:

- Personal Credit: Most small business lenders require a business owner to have good personal credit scores.

- Business Credit: Strong business credit scores and reports make qualifying for loans easier.

- Business Income: Most types of business financing require that you show some type of income.

- Collateral: It’s a lot easier to get approved for collateral-based loans, such as vehicle loans, commercial mortgage loans, and equipment financing.

- Time in Business: Many business lenders like to see at least 2 or 3 years in business.

- Industry: Some industries have a hard time getting approved, regardless of how strong their financials are.

The Best $50k Business Loan Types

Bank Loans (Term Loans)

Traditional bank loans for businesses are called term loans. You make regular payments over a fixed “term”, like 3 or 5 years. They usually have fixed interest rates.

Requirements: Bank term loans usually require that the small business owner have good personal credit (FICO Scores of 680+), at least two years in business, and at least $100,000 in annual revenue.

SBA Loans

SBA Loans are traditional bank loans that the government guarantees. For this reason, the interest rates are unusually low and the terms can be very good. But they’re hard to qualify for.

There are many different types of SBA loans. 7a loans and 504 loans are the most common types.

Requirements: Each SBA loan has different requirements. But generally speaking, they require some time in business (at least one year), good personal credit scores, and some business revenue.

Business Line of Credit

Like term loans, business lines of credit are typically issued by traditional banks. They have low interest rates but are hard to qualify for.

When you get a business line of credit, it’s a loan that you can access over and over again – like a credit card. You have a credit limit that shows you how much you can draw down, such as $50,000, and then you have to make minimum payments over time to pay them off.

Requirements: Business lines of credit usually require that the small business owner have good personal credit (680+ FICO Scores), 2+ years in business, and $100,000+ in annual revenue.

Credit Line Hybrid

The Credit Line Hybrid is a unique product created by Credit Suite. Funding amounts are $10,000-$150,000, and they are no doc business loans with quick approval times.

Requirements: The Credit Line Hybrid requires good personal credit scores (FICO Score of 680+). New businesses with zero time in business, zero collateral, and low cash flow are welcome to apply. The Credit Line Hybrid is relatively easy to qualify for.

Business Credit Cards

Business credit cards are another financing product that’s easy to qualify for. They work just like personal credit cards. You’re assigned a credit limit that you can access at any time, then you make small, monthly payments over time to pay them down.

The main difference between business credit cards and personal ones is that business credit cards have higher credit limits than personal ones. And if you build your business credit, even small business owners can qualify for them without using their personal credit.

Requirements: Business credit cards require, at a minimum, good personal credit. Some of them have business revenue requirements, but not all.

Equipment Financing

Equipment financing is another product that is easier to qualify for. It involves either a loan or a lease that requires fixed monthly payments over time to purchase heavy equipment or machinery. If you’re looking for a $50,000 business loan to purchase equipment, start here.

Requirements: Equipment financing requires good personal credit.

Merchant Cash Advance

Merchant cash advances borrow against a business’s “merchant processing” system – credit card sales. Business owner credit scores and other considerations aren’t a major factor here.

Once financing is given, the borrower automatically pays back the debt over time as a percentage of sales – so there are no fixed payments.

The financing cost is very high for these, so they are to be avoided if a business owner can get financing any other way.

Requirements: Strong credit card sales, usually at least $10,000 per month. Bad credit is accepted.

Cash Flow Financing

Since merchant cash advances have severe limitations, Credit Suite offers an improved product – Cash Flow Financing. Cash flow financing is like a merchant cash advance, in that the borrower qualifies for the financing primarily based on their business’s cash flow.

But instead of limiting the financing to companies with credit card sales, all types of cash flow can be used to qualify.

Requirements: Strong cash flow, at least $10,000 per month. Below average credit scores accepted.

Looking for another loan amount? Consider these articles: $30k Business Loan Options, $40k Business Loan Options, $60k Business Loan Options, $70k Business Loan Options, $80k Business Loan Options, $90k Business Loan Options, and $100k Business Loan Options.