Please note: Lending options, rates, and qualifications change regularly. The information in this post is based off of requirements as of original posting date of July 2, 2024.

Securing a $600,000 loan for your business signifies a significant achievement, and our manual is prepared to assist every step of the way. Selecting the appropriate loan is crucial, as every financing choice comes with distinct stipulations.

As with all types of lending, you need to reach different requirements with the proper Fundability in order to fully qualify. This article is giving you the information you need to understand the starting points for some of the most common types of funding available. Additionally, it’s important to keep maximum approval amounts in mind when searching for funding. You will find each one we touch on in this article have a wide range of maximum limits. But with the correct combination, you have the possibility to reach those funding needs and wants much easier.

The table below has the requirements for each major business loan type.

The Best $600k Business Loans

| Loan Type | Requirements | Approval Difficulty |

| Bank Loan (Term Loan) | Good credit, 2 years in business, business cash flow | Hard |

| Business Line of Credit | Good credit, 2 years in business, business cash flow | Hard |

| SBA Loan | Good credit, 2 years in business, business cash flow | Hard |

| Credit Line Hybrid | Good credit | Easy (No Doc) |

| Business Credit Card | Good credit | Easy |

| Equipment Financing | Good credit | Easy |

| Merchant Cash Advance | Credit card sales, bad credit | Easy |

| Cash Flow Financing | Business cash flow, fair credit | Easy |

How to Qualify for a $600,000 Business Loan

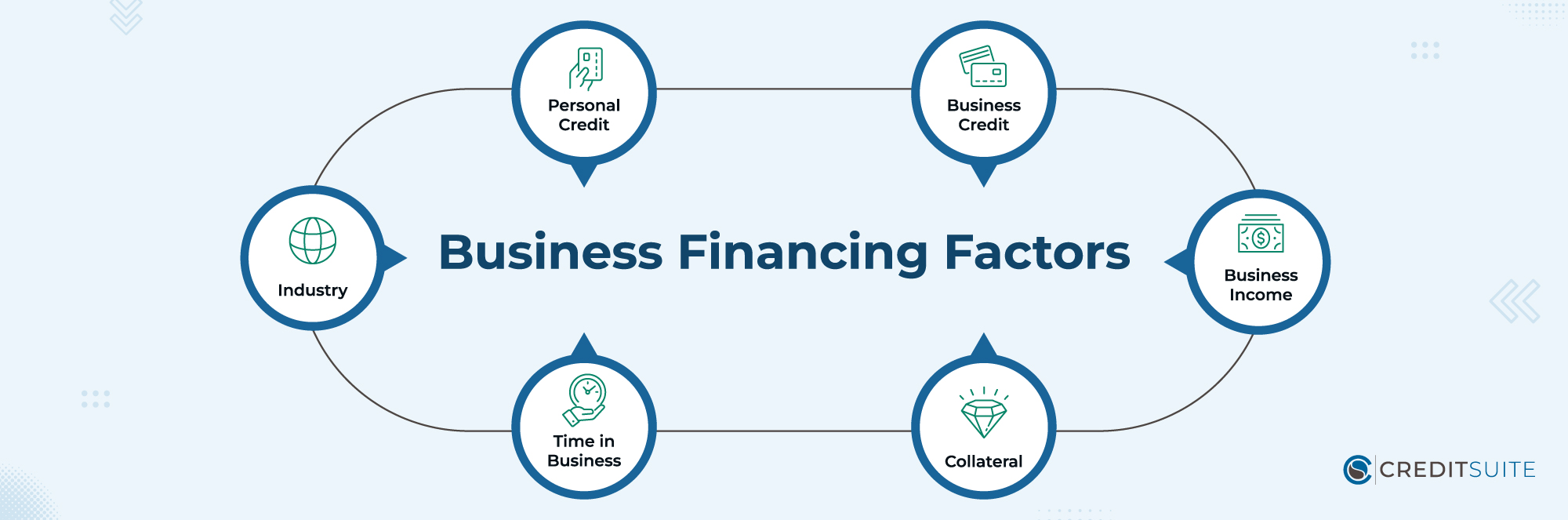

Obtaining a business loan depends on six essential elements. Conventional bank loans require mastery in these areas, whereas alternative financing routes may offer more flexibility. These critical components include:

- Personal Credit: Numerous niche financiers focusing on small businesses typically require entrepreneurs to maintain high personal credit ratings.

- Business Credit: Building robust business credit ratings and detailed profiles can streamline the process of getting a loan approved.

- Business Income: In business financing, most methods for obtaining funds often demand documentation of earnings as an essential prerequisite.

- Collateral: Securing authorization for loans secured by assets, like car loans, business real estate mortgages, and equipment financing, usually entails more streamlined procedures.

- Time in Business: The majority of business lending institutions generally prefer to deal with companies that boast a history of two to three years.

- Industry: Despite having a stable financial base, specific industries might face hurdles in obtaining approval.

The Best $600k Business Loan Types

Bank Loans (Term Loans)

Business loans from traditional banking institutions frequently go by the term “term loans.” This involves periodic repayments across a designated “term,” usually spanning 3 to 5 years. This type of financing commonly features steady interest rates.

Requirements: For eligibility of bank term loans, business owners usually need a robust personal credit history (FICO Scores above 680), an enterprise active for at least two years, and annual sales surpassing $100,000.

Business Line of Credit

Obtaining acceptance for business lines of credit, comparable to term loans, is typically a service of standard banks. Even though the interest rates might be enticing, the prerequisites for qualification can be stringent.

Once approved, you gain access to a loan that works much like a credit card, providing flexibility for multiple uses. A specified credit limit, say $600,000, is set, with gradual repayments needed to address the remaining balance.

Requirements: To be eligible for business credit lines, owners of small businesses typically need a strong personal credit background (with FICO Scores exceeding 680), at least two years of running the business, and annual earnings over $100,000.

SBA Loans

Combining support from mainstream banks with federal assistance, SBA Loans offer favorable terms and lower interest rates. However, maneuvering through the approval process for these loans can be a bit tricky.

Various SBA loan alternatives are available, with the 7a and 504 loans emerging as preferred selections.

Requirements: To be eligible for SBA loans, businesses often must showcase at least one year of operational experience, possess a strong personal credit profile, and meet specific revenue criteria.

Credit Line Hybrid

Credit Suite presents a pioneering solution called the Credit Line Hybrid, guaranteeing swift approval for business funding ranging from $10,000 to $150,000, with minimal paperwork required.

Requirements: The Credit Line Hybrid requires a strong personal credit score (FICO 680 or higher). It’s accessible to startups lacking a track record, collateral, or significant cash flow, making the application process easier.

Business Credit Cards

Business credit cards provide another route for financial assistance, boasting simple eligibility requirements. Functioning similarly to personal credit cards, they offer a credit line that demands monthly settlements.

The main contrast between business and personal credit cards is the typically elevated credit limits offered to businesses. Additionally, establishing a credit history for the business allows entrepreneurs to access these cards without relying solely on their personal credit histories.

Requirements: In general, business credit cards often demand a strong personal credit history, and sometimes, they might also assess the revenue of the company.

Equipment Financing

Securing equipment financing provides a simpler route to qualify compared to other alternatives.

This involves arranging either a loan or lease with regular monthly payments to procure machinery or heavy equipment. If you’re in need of financing, particularly for a $600,000 equipment acquisition loan, this choice warrants careful consideration.

Requirements: When considering equipment financing, it’s crucial to have a solid personal credit history and a sincere commitment to engage in the process.

Merchant Cash Advance

By leveraging a business’s “merchant processing” system, merchant cash advances oversee credit card transactions. In this setup, the business owner’s creditworthiness and supplementary factors carry less weight.

Upon receiving the funds, repayment occurs automatically, with a percentage of sales deducted, eliminating the necessity for fixed payment schedules.

Given their elevated financing costs, these advances should be viewed as a final option when the business owner has access to alternative funding avenues.

Requirements: A consistent stream of monthly earnings from credit card transactions, ideally exceeding $10,000, is highly valued. In these instances, having less-than-perfect credit is considered permissible.

Cash Flow Financing

Recognizing the limitations of merchant cash advances, Credit Suite introduces a better alternative called Cash Flow Financing. Similar to merchant cash advances, the primary requirement for this financial solution is the company’s cash flow.

However, Cash Flow Financing distinguishes itself by not limiting eligibility only to businesses that rely on credit card sales for revenue. Instead, it considers all sources of cash flow. Requirements: Strong cash flow, at least $10,000 per month. Below average credit scores accepted.

Looking for another loan amount? Consider these articles: $900k Business Loan Options, $800k Business Loan Options, $700k Business Loan Options, $500k Business Loan Options, $400k Business Loan Options, $300k Business Loan Options, $250k Business Loan Options, $200k Business Loan Options, $150k Business Loan Options, and $100k Business Loan Options.