Please note: Lending options, rates, and qualifications change regularly. The information in this post is based off of requirements as of original posting date of July 2, 2024.

Securing a $70k business loan is a significant achievement, and our guide is designed to navigate you through the process. Every business loan and finance option comes with its own set of criteria, helping you choose the correct loan crucial to your success.

As with all types of lending, you need to reach different requirements with the proper Fundability in order to fully qualify. This article is giving you the information you need to understand the starting points for some of the most common types of funding available. Additionally, it’s important to keep maximum approval amounts in mind when searching for funding. You will find each one we touch on in this article have a wide range of maximum limits. But with the correct combination, you have the possibility to reach those funding needs and wants much easier.

The table below has the requirements for each major business loan type.

The Best $70k Business Loans

| Loan Type | Requirements | Approval Difficulty |

| Bank Loan (Term Loan) | Good credit, 2 years in business, business cash flow | Hard |

| Business Line of Credit | Good credit, 2 years in business, business cash flow | Hard |

| SBA Loan | Good credit, 2 years in business, business cash flow | Hard |

| Credit Line Hybrid | Good credit | Easy (No Doc) |

| Business Credit Card | Good credit | Easy |

| Equipment Financing | Good credit | Easy |

| Merchant Cash Advance | Credit card sales, bad credit | Easy |

| Cash Flow Financing | Business cash flow, fair credit | Easy |

How to Qualify for a $70,000 Business Loan

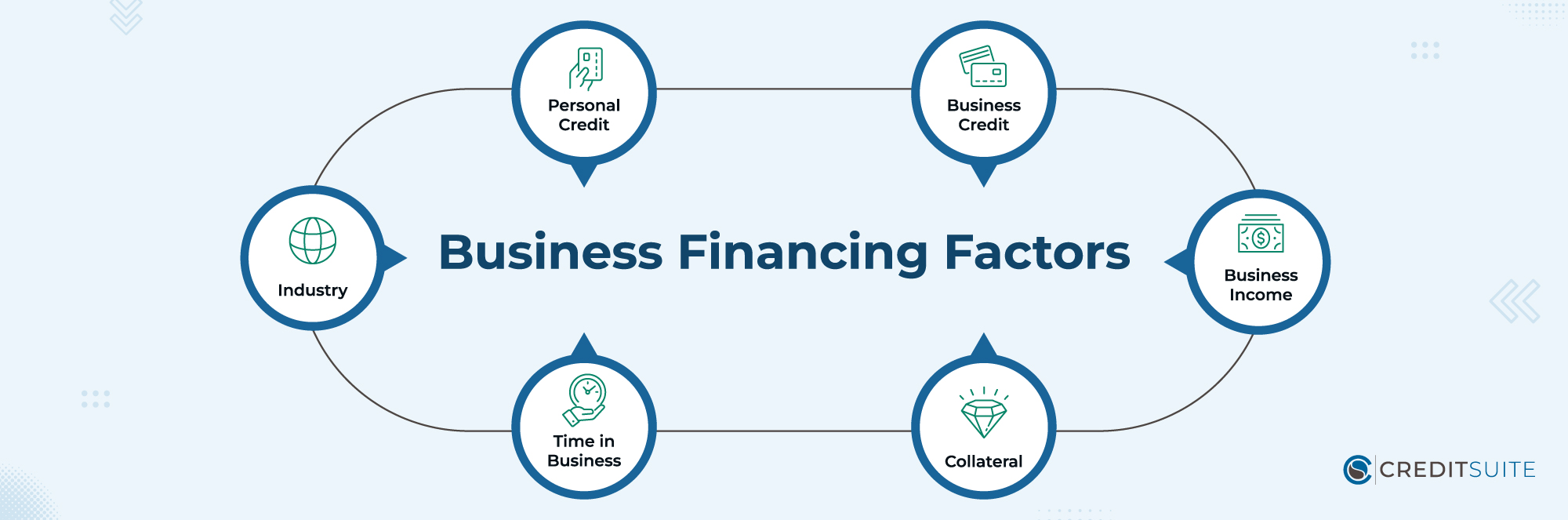

Meeting the criteria for a business loan hinges on six key components. Securing traditional bank financing requires a strong performance across all these facets, while other financing avenues may be more accommodating. These components include:

- Personal Credit: Many lenders focusing on smaller enterprises expect the individual running the business to possess strong personal credit ratings.

- Business Credit: Solid business credit assessments and profiles facilitate the loan qualification process.

- Business Income: Nearly all forms of business lending demand proof of some sort of earnings.

- Collateral: Securing approval for loans backed by assets, like car financing, business property mortgages, and machinery loans, tends to be significantly smoother.

- Time in Business: A lot of commercial lenders favor seeing a business track record of at least two or three years.

- Industry: Certain sectors struggle to gain approval, no matter the robustness of their financial situation.

The Best $70k Business Loan Types

Bank Loans (Term Loans)

Business loans from conventional banks are termed as term loans. They require regular payments over a defined “term,” typically 3 to 5 years, and commonly feature fixed interest rates.

Requirements: Term loans from banks often necessitate that the owner of a small business possesses strong personal credit (FICO Scores above 680), a minimum business operation of two years, and annual revenues of no less than $100,000.

Business Line of Credit

Similar to term loans, business lines of credit are usually provided by conventional banks. They feature low interest rates, yet qualifying for them is challenging.

Obtaining a business line of credit means you receive a loan that can be utilized repeatedly – akin to how a credit card functions.

You’re given a credit ceiling that indicates the maximum you can withdraw, for instance, $70,000, followed by the requirement to make minimum payments gradually to settle the balance.

Requirements: Lines of credit for businesses often demand that the proprietor of the small business possess strong personal credit (FICO Scores over 680), more than two years of business activity, and annual earnings exceeding $100,000.

SBA Loans

SBA Loans consist of conventional bank lending backed by a government guarantee. Due to this support, the interest rates remain notably low, and the conditions can be quite favorable. However, securing them can be challenging.

A variety of SBA loan categories exist, with 7a and 504 loans being the predominant types.

Requirements: Every SBA loan comes with its own set of criteria. However, broadly speaking, they necessitate a period of operation (minimum of one year), favorable personal credit ratings, and a certain level of business income.

Credit Line Hybrid

The Credit Line Hybrid is an innovative offering developed by Credit Suite. Financing ranges from $10,000 to $150,000, and these are no-documentation business loans featuring rapid approval processes.

Requirements: The Credit Line Hybrid demands strong personal credit ratings (FICO Score above 680). Start-ups with no operational history, absence of collateral, and minimal cash flow can submit applications. Qualifying for the Credit Line Hybrid tends to be comparatively straightforward.

Business Credit Cards

Business credit cards represent an additional funding option that’s straightforward to get approved for.

They function similarly to personal credit cards, providing you with a credit line available for use whenever needed, followed by the obligation to cover the balance with modest, monthly installments.

The key distinction between business and personal credit cards lies in the former offering greater credit ceilings than the latter. Moreover, by establishing business credit, even proprietors of small enterprises can secure these cards without relying on their individual credit histories.

Requirements: At the very least, obtaining business credit cards necessitates having a solid personal credit score. While some demand proof of business income, this isn’t a universal requirement.

Equipment Financing

Equipment financing presents a more accessible qualification process compared to other options. It involves obtaining a loan or entering a lease agreement with fixed monthly payments over time for the purchase of heavy equipment or machinery.

If you’re seeking a $70,000 business loan for equipment acquisition, this avenue is worth exploring.

Requirements: For equipment financing, having a solid personal credit history is essential, along with your eagerness to be part of the process.

Merchant Cash Advance

Merchant cash advances are obtained based on a business’s “merchant processing” capability which also involves credit card transactions. In this setup, the creditworthiness of the business owner and other qualifications hold minimal sway.

Upon receiving the funds, repayment is automated through deductions from sales, circumventing the need for fixed payment timetables.

Due to their steep financing expenses, these advances should only be pursued as a final option if alternative funding routes are open to the business owner.

Requirements: Consistent monthly credit card income, preferably exceeding $10,000, is desirable. Less than perfect credit is acceptable.

Cash Flow Financing

Given the constraints associated with merchant cash advances, Credit Suite provides an enhanced alternative called Cash Flow Financing. Similar to a merchant cash advance, eligibility for this financing primarily hinges on a business’s cash flow.

However, unlike merchant cash advances, Cash Flow Financing doesn’t restrict qualification to companies with credit card sales alone; all forms of cash flow are considered.

Requirements: Strong cash flow, at least $10,000 per month. Below average credit scores accepted.

Looking for another loan amount? Consider these articles: $30k Business Loan Options, $40k Business Loan Options, $50k Business Loan Options, $60k Business Loan Options, $80k Business Loan Options, $90k Business Loan Options, and $100k Business Loan Options.