Please note: Lending options, rates, and qualifications change regularly. The information in this post is based off of requirements as of original posting date of July 2, 2024.

Securing an $800,000 loan for your enterprise signifies a significant achievement, and our manual is dedicated to assisting you at every phase. Selecting the appropriate loan is crucial since every funding alternative comes with its distinct set of terms and conditions.

As with all types of lending, you need to reach different requirements with the proper Fundability in order to fully qualify. This article is giving you the information you need to understand the starting points for some of the most common types of funding available. Additionally, it’s important to keep maximum approval amounts in mind when searching for funding. You will find each one we touch on in this article have a wide range of maximum limits. But with the correct combination, you have the possibility to reach those funding needs and wants much easier.

The table below has the requirements for each major business loan type.

The Best $800k Business Loans

| Loan Type | Requirements | Approval Difficulty |

| Bank Loan (Term Loan) | Good credit, 2 years in business, business cash flow | Hard |

| Business Line of Credit | Good credit, 2 years in business, business cash flow | Hard |

| SBA Loan | Good credit, 2 years in business, business cash flow | Hard |

| Credit Line Hybrid | Good credit | Easy (No Doc) |

| Business Credit Card | Good credit | Easy |

| Equipment Financing | Good credit | Easy |

| Merchant Cash Advance | Credit card sales, bad credit | Easy |

| Cash Flow Financing | Business cash flow, fair credit | Easy |

How to Qualify for a $800,000 Business Loan

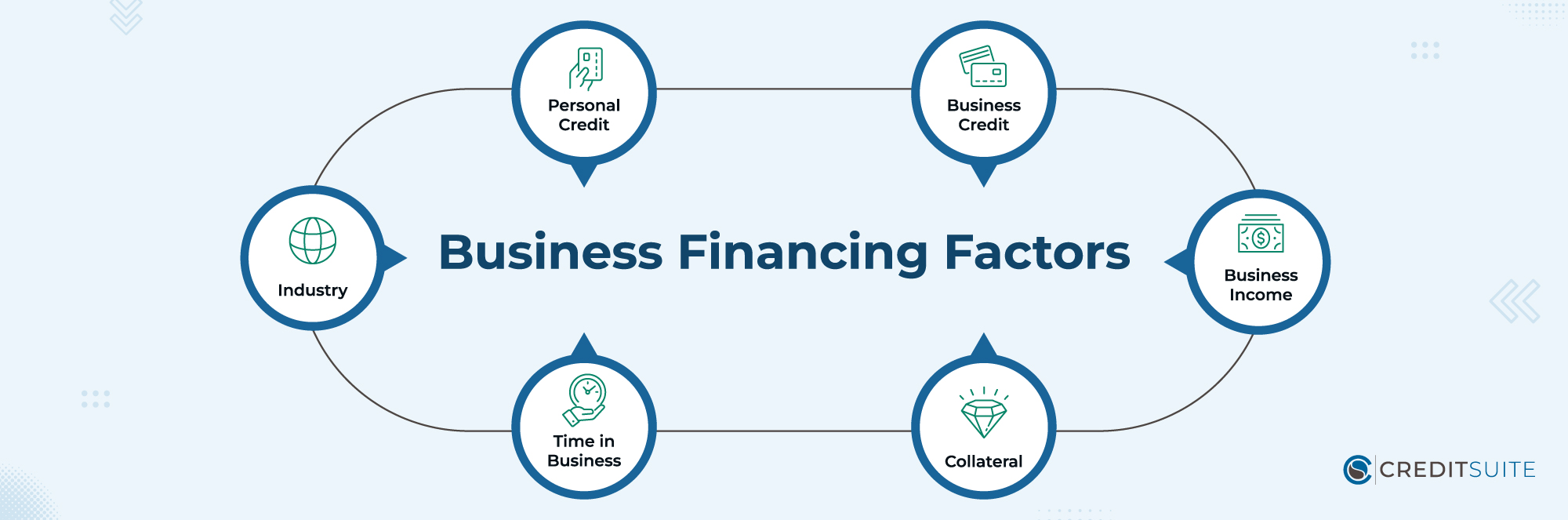

Obtaining a business loan depends on six essential criteria. Conventional bank loans require proficiency in these areas, whereas other financing routes may offer more flexibility. These important factors include:

- Personal Credit: Numerous niche lenders focusing on small enterprises typically anticipate that entrepreneurs maintain solid personal credit ratings.

- Business Credit: Building strong business credit ratings and detailed profiles can accelerate the loan approval process.

- Business Income: In the field of business funding, the process of securing financial support generally demands the submission of income proof as an essential criterion.

- Collateral: Gaining approval for collateral-based loans, like automobile financing, business property mortgages, and equipment funding, usually entails more simplified processes.

- Time in Business: The majority of commercial lending institutions generally prefer to collaborate with businesses that possess a history of two to three years.

- Industry: Even possessing a strong financial background, particular fields might find challenges in achieving authorization.

The Best $800k Business Loan Types

Bank Loans (Term Loans)

Financing for businesses through traditional banks is commonly known as “term loans.” This arrangement involves periodic repayments across a designated “term,” usually spanning 3 to 5 years. These financing alternatives often feature fixed interest rates.

Requirements: For eligibility for bank term loans, business owners generally need a robust personal credit history (FICO Scores above 680), a minimum of two years in business operation, and annual earnings over $100,000.

Business Line of Credit

Gaining acceptance for business lines of credit, similar to term loans, is frequently provided by conventional banks. Although the interest rates might seem attractive, the criteria to qualify are stringent.

Once approved, you receive a loan functioning much like a credit card, allowing flexibility for multiple uses. A specific credit ceiling, for instance, $800,000, is set, with progressive payments needed to pay off the due balance.

Requirements: To be eligible for business credit lines, small business proprietors typically need a solid personal credit record (with FICO Scores above 680), at least two years of business activity, and yearly incomes over $100,000.

SBA Loans

Combining support from conventional banks and federal guarantees, SBA Loans offer favorable conditions and lower interest rates. However, maneuvering through the approval procedure for these loans may present some obstacles.

Multiple SBA loan variants are available for consideration, notably the 7a and 504 loans as common selections.

Requirements: To be eligible for SBA loans, companies usually must show at least one year of operational experience, uphold a strong personal credit background, and meet specific revenue criteria.

Credit Line Hybrid

Credit Suite presents a creative solution called the Credit Line Hybrid, guaranteeing swift authorization for business funding between $10,000 and $150,000, requiring only limited paperwork.

Requirements: The Credit Line Hybrid requires a strong personal credit rating (FICO 680 or above), designed for startups lacking historical data, assets, or substantial cash flow, simplifying the application journey.

Business Credit Cards

Business credit cards provide a different avenue for financial aid, with easy-to-meet eligibility requirements. Similar to personal credit cards, they provide a credit line with the necessity for monthly payments.

The main distinction between business and personal credit cards is the typically larger credit limits offered to companies. Furthermore, establishing a credit history for the business allows entrepreneurs to secure these cards without relying solely on their personal credit histories.

Requirements: Business credit cards fundamentally require solid personal credit. Some mandate criteria related to business earnings, but this is not a universal requirement across all cards.

Equipment Financing

Securing financing for equipment presents a less complicated route to qualification compared to alternative methods.

This involves establishing either a loan or lease agreement with regular monthly payments for the acquisition of machinery or significant equipment. Should you need financing, particularly for an $800,000 equipment purchase, this alternative warrants careful consideration.

Requirements: In pursuing equipment financing, it’s vital to have a solid personal credit profile and a real willingness to be involved in the process.

Merchant Cash Advance

Employing a business’s “merchant processing” setup, merchant cash advances regulate credit card revenue. Within this framework, the credit status of the business owner and other considerations take a backseat.

Following the issuance of funds, repayments occur automatically, with a fraction of sales being appropriated, negating the necessity for predetermined payment plans.

Considering their increased financing charges, these advances should be regarded as a last option when business owners have the possibility to seek other financial resources.

Requirements: A consistent monthly income from credit card transactions, ideally over $10,000, is highly valued. In these cases, having less-than-perfect credit is considered acceptable.

Cash Flow Financing

Acknowledging the restrictions of merchant cash advances, Credit Suite offers a more beneficial alternative called Cash Flow Financing. Like merchant cash advances, this financing method emphasizes the importance of a business’s cash flow for qualification.

What sets Cash Flow Financing apart is its broad eligibility criteria, not limited to businesses with income from credit card sales. It assesses a business’s total cash flow streams instead.

Requirements: Strong cash flow, at least $10,000 per month. Below average credit scores accepted.

Looking for another loan amount? Consider these articles: $900k Business Loan Options, $700k Business Loan Options, $600k Business Loan Options, $500k Business Loan Options, $400k Business Loan Options, $300k Business Loan Options, $250k Business Loan Options, $200k Business Loan Options, $150k Business Loan Options, and $100k Business Loan Options.