Please note: Lending options, rates, and qualifications change regularly. The information in this post is based off of requirements as of original posting date of July 2, 2024.

Obtaining a $900,000 loan for your business marks a notable milestone, and our guide is committed to supporting you through each stage. Choosing the right loan is essential, as each financing option has its unique terms and conditions.

As with all types of lending, you need to reach different requirements with the proper Fundability in order to fully qualify. This article is giving you the information you need to understand the starting points for some of the most common types of funding available. Additionally, it’s important to keep maximum approval amounts in mind when searching for funding. You will find each one we touch on in this article have a wide range of maximum limits. But with the correct combination, you have the possibility to reach those funding needs and wants much easier.

The table below has the requirements for each major business loan type.

The Best $900k Business Loans

| Loan Type | Requirements | Approval Difficulty |

| Bank Loan (Term Loan) | Good credit, 2 years in business, business cash flow | Hard |

| Business Line of Credit | Good credit, 2 years in business, business cash flow | Hard |

| SBA Loan | Good credit, 2 years in business, business cash flow | Hard |

| Credit Line Hybrid | Good credit | Easy (No Doc) |

| Business Credit Card | Good credit | Easy |

| Equipment Financing | Good credit | Easy |

| Merchant Cash Advance | Credit card sales, bad credit | Easy |

| Cash Flow Financing | Business cash flow, fair credit | Easy |

How to Qualify for a $900,000 Business Loan

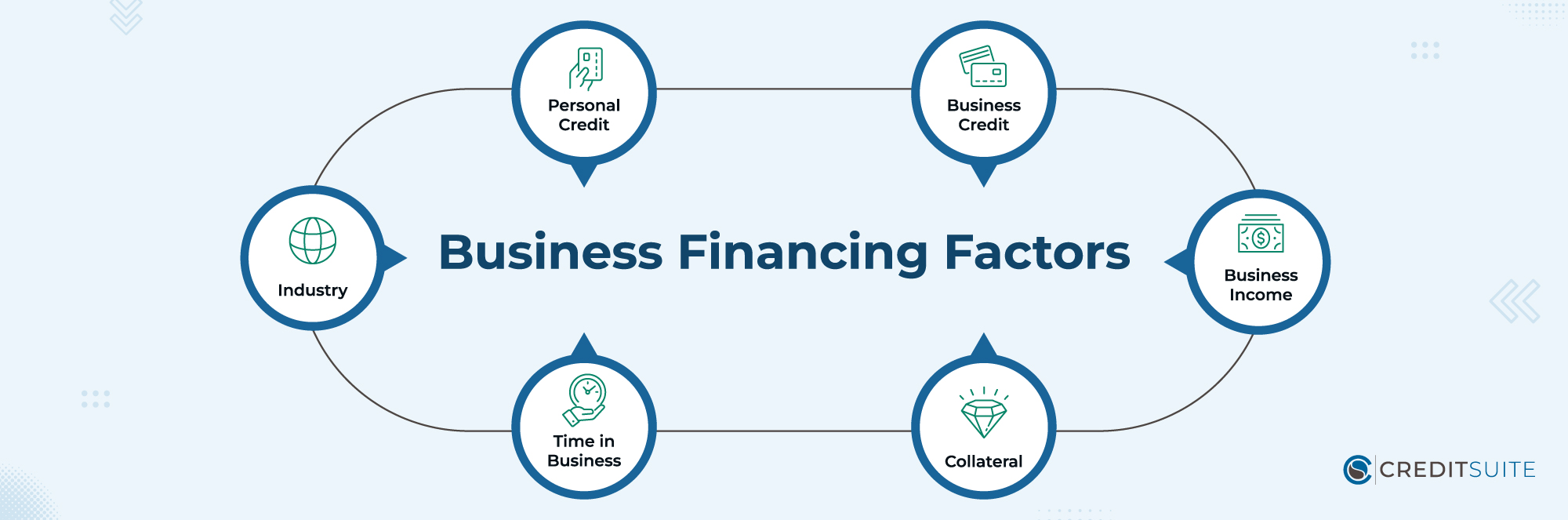

Securing a business loan hinges on six key factors. Traditional bank loans necessitate expertise in these domains, while alternative funding paths might provide more leeway. The crucial elements encompass:

- Personal Credit: Many specialized lenders targeting small businesses often expect entrepreneurs to uphold strong personal credit scores.

- Business Credit: Developing solid business credit scores and thorough profiles can speed up the loan approval journey.

- Business Income: In the domain of business finance, acquiring monetary backing often entails the necessity to present proof of income as a fundamental prerequisite.

- Collateral: Securing authorization for secured loans, such as car loans, commercial property mortgages, and equipment finance, typically involves more streamlined procedures.

- Time in Business: Most business lending organizations usually favor partnering with enterprises that have a track record of two to three years.

- Industry: Despite having a solid financial foundation, certain industries may encounter difficulties when seeking approval.

The Best $900k Business Loan Types

Bank Loans (Term Loans)

Business loans from traditional banks, termed as “term loans,” involve regular payments over a fixed “term” of typically 3 to 5 years, often with fixed interest rates.

Requirements: To qualify for bank term loans, entrepreneurs typically require a strong personal credit record (FICO Scores exceeding 680), a business operational history of at least two years, and annual revenue surpassing $100,000.

Business Line of Credit

Obtaining approval for business lines of credit, much like term loans, is commonly facilitated by mainstream banks. While the interest rates might appear enticing, meeting the eligibility criteria can be stringent.

Once sanctioned, you acquire a loan that functions similarly to a credit card, providing flexibility for diverse uses. A specific credit limit, such as $900,000, is established, necessitating gradual payments to clear the outstanding balance.

Requirements: In order to qualify for business credit lines, small business owners usually require a strong personal credit history (with FICO Scores exceeding 680), a minimum of two years of business activity, and annual revenues surpassing $100,000.

SBA Loans

By merging assistance from traditional banks with federal backing, SBA Loans provide advantageous terms and reduced interest rates. Nonetheless, navigating the approval process for these loans may encounter certain hurdles.

There are various SBA loan options to explore, with the 7a and 504 loans being popular choices.

Requirements: For businesses to qualify for SBA loans, they generally need to exhibit at least one year of operational experience, maintain a robust personal credit history, and meet specific revenue requirements.

Credit Line Hybrid

Credit Suite offers an innovative option known as the Credit Line Hybrid, ensuring quick approval for business financing ranging from $10,000 to $150,000, with minimal paperwork needed.

Requirements: The Credit Line Hybrid necessitates a robust personal credit score (FICO 680 or higher), tailored for startups that lack historical data, assets, or significant cash flow, streamlining the application process.

Business Credit Cards

Business credit cards offer an alternative route for financial assistance, boasting straightforward eligibility criteria. Much like personal credit cards, they extend a credit line with obligatory monthly payments.

The key contrast between business and personal credit cards lies in the generally higher credit limits extended to companies. Moreover, building a credit track record for the business enables entrepreneurs to obtain these cards without solely depending on their personal credit backgrounds.

Requirements: Business credit cards primarily demand a strong personal credit history. While certain cards may consider business revenue as a criterion, it’s not a standard requirement across the board.

Equipment Financing

Obtaining funding for equipment offers a simpler path to eligibility when compared to other approaches. This entails setting up a loan or lease arrangement with consistent monthly payments to acquire machinery or substantial equipment. If you require financing, especially for a $900,000 equipment acquisition, this option deserves thorough deliberation.

Requirements: When seeking equipment financing, it’s crucial to maintain a strong personal credit record and a genuine eagerness to participate in the process.

Merchant Cash Advance

Utilizing a business’s “merchant processing” system, merchant cash advances manage credit card proceeds. In this arrangement, the creditworthiness of the business owner and other factors are less emphasized.

After receiving the funds, repayments are automated, with a portion of sales allocated, eliminating the need for fixed payment schedules.

Given their higher financing costs, these advances should be considered a final resort when business owners have the opportunity to explore alternative financial avenues.

Requirements: A steady monthly revenue from credit card transactions, preferably exceeding $10,000, holds significant importance. In such instances, having less-than-ideal credit is generally deemed acceptable.

Cash Flow Financing

Recognizing the limitations of merchant cash advances, Credit Suite provides a superior option known as Cash Flow Financing. Similar to merchant cash advances, this financing avenue prioritizes a business’s cash flow when assessing eligibility.

What distinguishes Cash Flow Financing is its inclusive eligibility standards, which aren’t confined to businesses relying solely on income from credit card sales. Instead, it evaluates all streams of a business’s cash flow.

Requirements: Strong cash flow, at least $10,000 per month. Below average credit scores accepted.

Looking for another loan amount? Consider these articles: $800k Business Loan Options, $700k Business Loan Options, $600k Business Loan Options, $500k Business Loan Options, $400k Business Loan Options, $300k Business Loan Options, $250k Business Loan Options, $200k Business Loan Options, $150k Business Loan Options, and $100k Business Loan Options.