Please note: Lending options, rates, and qualifications change regularly. The information in this post is based off of requirements as of original posting date of July 2, 2024.

Securing a $90,000 business loan is a significant achievement, and our guide is designed to assist you in the process. Selecting the appropriate loan is crucial, as each financing option comes with its own set of criteria.

As with all types of lending, you need to reach different requirements with the proper Fundability in order to fully qualify. This article is giving you the information you need to understand the starting points for some of the most common types of funding available. Additionally, it’s important to keep maximum approval amounts in mind when searching for funding. You will find each one we touch on in this article have a wide range of maximum limits. But with the correct combination, you have the possibility to reach those funding needs and wants much easier.

The table below has the requirements for each major business loan type.

The Best $90k Business Loans

| Loan Type | Requirements | Approval Difficulty |

| Bank Loan (Term Loan) | Good credit, 2 years in business, business cash flow | Hard |

| Business Line of Credit | Good credit, 2 years in business, business cash flow | Hard |

| SBA Loan | Good credit, 2 years in business, business cash flow | Hard |

| Credit Line Hybrid | Good credit | Easy (No Doc) |

| Business Credit Card | Good credit | Easy |

| Equipment Financing | Good credit | Easy |

| Merchant Cash Advance | Credit card sales, bad credit | Easy |

| Cash Flow Financing | Business cash flow, fair credit | Easy |

How to Qualify for a $90,000 Business Loan

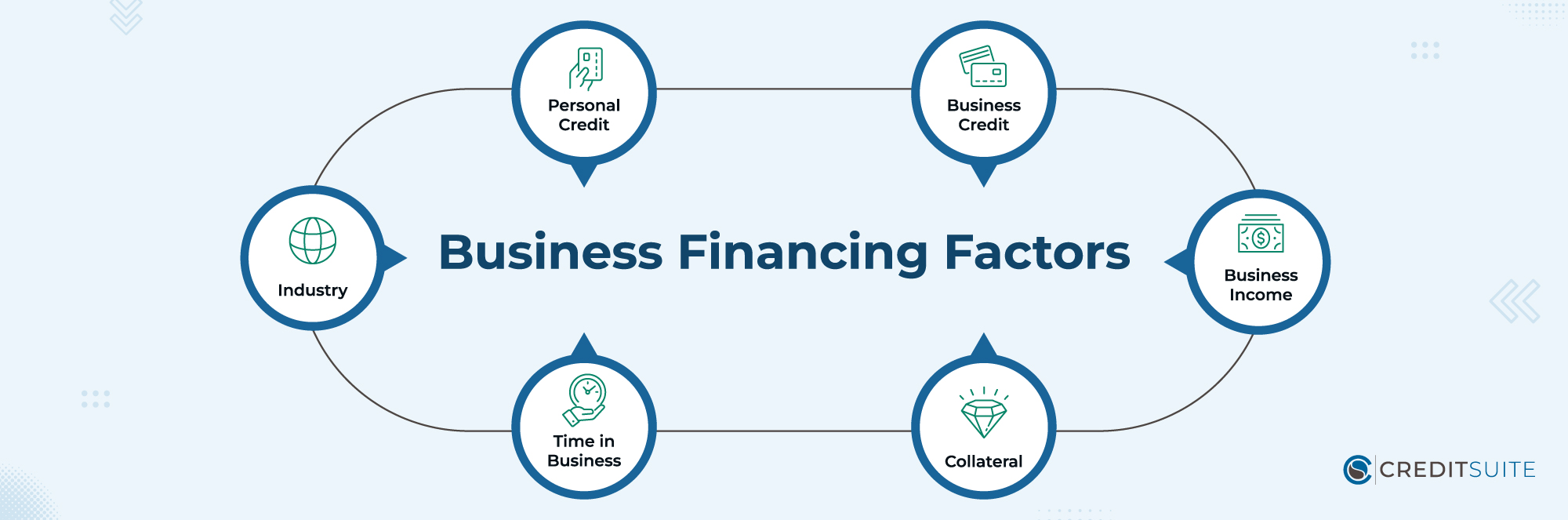

Securing approval for a business loan relies on six key factors. Traditional bank loans require proficiency in each of these aspects, while alternative financing avenues might provide more leeway. These factors include:

- Personal Credit: Many lenders focusing on small businesses expect the business owner to maintain strong personal credit ratings.

- Business Credit: Strong business credit scores and detailed reports contribute to making the loan qualification process smoother.

- Business Income: Nearly all types of business financing require some form of revenue validation.

- Collateral: Securing approval for loans supported by assets, like auto loans, business property mortgages, and equipment loans, often unfolds with greater ease.

- Time in Business: Many commercial lenders typically favor seeing a business history spanning two to three years.

- Industry: Even with solid financial positions, certain industries face challenges in securing approval.

The Best $90k Business Loan Types

Bank Loans (Term Loans)

Business loans provided by traditional banks are known as term loans. These involve making regular payments over a specified “term,” often ranging from 3 to 5 years. Generally, they come with fixed interest rates.

Requirements: For bank term loans, small business owners generally need a strong personal credit history (FICO Scores above 680), a business operating for at least two years, and annual revenues of at least $100,000.

Business Line of Credit

Business credit lines, much like term loans, are commonly offered by conventional banks. Although they offer attractive interest rates, satisfying the eligibility requirements can pose a challenge.

Upon approval, you receive a loan functioning akin to a credit card, facilitating repeated utilization. A credit ceiling is assigned, such as $90,000, and you’re mandated to make gradual payments to settle the obligation.

Requirements: To qualify for business lines of credit, small business proprietors generally need robust personal credit (FICO Scores exceeding 680), a business history of no less than two years, and yearly revenues exceeding $100,000.

SBA Loans

SBA loans blend conventional bank funding with government support, resulting in reduced interest rates and advantageous terms. However, securing them may present hurdles.

Various categories of SBA loans exist, with the 7a and 504 loans being the primary choices accessible.

Requirements: SBA loans have different requirements, but generally, they require a track record (usually at least one year), satisfactory personal credit scores, and a certain level of business revenue.

Credit Line Hybrid

Credit Suite introduces its distinctive offering, Credit Line Hybrid, providing swift approvals for no-documentation business loans spanning from $10,000 to $150,000.

Requirements: To qualify for the Credit Line Hybrid, a solid personal credit score (FICO 680+) is required. New businesses with no history, collateral, or strong cash flow can still apply, simplifying the process.

Business Credit Cards

Business credit cards provide another financing option with relatively simple qualification criteria. Functioning like personal credit cards, they offer access to a credit line, followed by monthly repayments.

The main contrast between business and personal cards lies in the former’s tendency to offer higher credit limits. Moreover, establishing business credit allows entrepreneurs to acquire these cards without solely relying on their personal credit history.

Requirements: Business credit cards often demand a strong personal credit history, and in some cases, they may also consider business income.

Equipment Financing

Equipment financing provides an easier path to qualification compared to other options. It involves obtaining a loan or lease with set monthly payments for purchasing machinery or heavy equipment.

If you require a $90,000 loan for equipment acquisition, this choice merits exploration.

Requirements: Having a solid personal credit history is vital in equipment financing, as is your readiness to participate in the procedure.

Merchant Cash Advance

Merchant cash advances are based on a business’s “merchant processing” platform, which oversees credit card transactions. In this setup, the business owner’s creditworthiness and other factors hold minimal significance.

After receiving the funds, repayment is automated through sales deductions, removing the necessity for fixed payment schedules.

Due to their expensive financing rates, these advances should only be pursued as a final option if alternative funding routes are accessible to the business owner.

Requirements: Consistent monthly income from credit card transactions, ideally exceeding $10,000, is desired. Less-than-ideal credit is acceptable.

Cash Flow Financing

Recognizing the limitations of merchant cash advances, Credit Suite offers a more advantageous option called Cash Flow Financing. Like merchant cash advances, eligibility for this financing primarily depends on a business’s cash flow.

However, unlike merchant cash advances, Cash Flow Financing doesn’t restrict qualification to businesses with credit card sales alone; it considers all types of cash flow.

Requirements: Strong cash flow, at least $10,000 per month. Below average credit scores accepted.

Looking for another loan amount? Consider these articles: $30k Business Loan Options, $40k Business Loan Options, $50k Business Loan Options, $60k Business Loan Options, $70k Business Loan Options, $80k Business Loan Options, and $100k Business Loan Options.