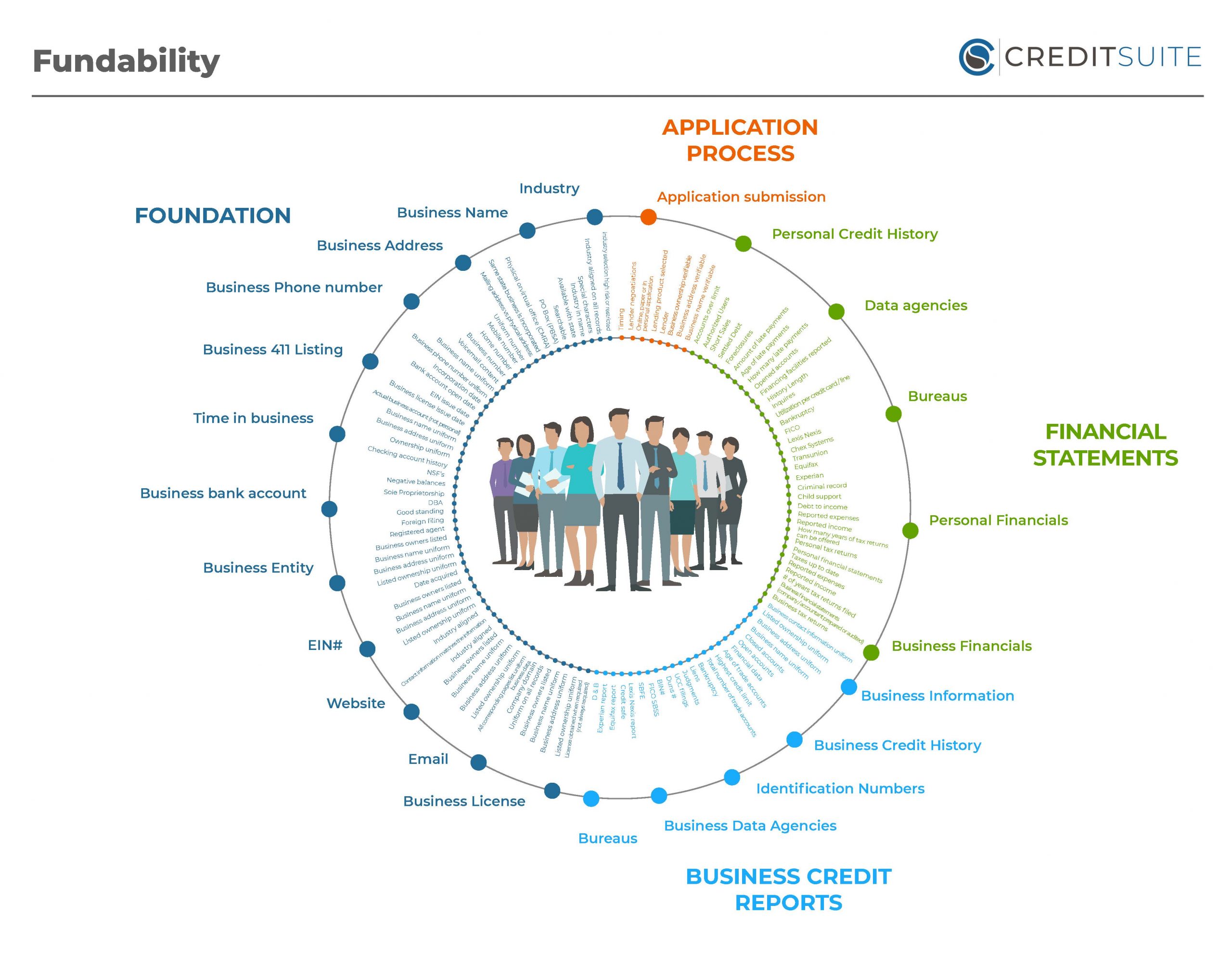

There are 125 factors that affect the fundability of your business. They break down into more general core principles. One such area is business financials.

Business Financials and Fundability™

It probably comes as no surprise that your business financials affect the Fundability of your business. But, what are lenders looking for? Is it just income and expense? Do they want tax returns and financial statements?

Start With The Basics: What is Fundability?

Initially, it may help to remember exactly what fundability is. Put simply, fundability is the ability of a business to get funding. It encompasses a number of things. The business financial information is just one. Now, let’s break down each factor within this principle.

Business Tax Returns

For maximum fundability, lenders like to see at least 3 years of business tax returns. Some traditional lenders will not even consider an application without this.

For maximum fundability, lenders like to see at least 3 years of business tax returns. Some traditional lenders will not even consider an application without this.

Sometimes, these are the only financials they need to see. The longer your tax history, the better. Of course, all tax returns need to be up to date and taxes paid. If you aren’t paying your taxes, lenders will not believe you will pay a loan.

Mainly, they will want to see that you are solvent. That means, you can meet your obligations. Even if tax returns are enough, your fundability will be stronger if you can provide financial statements as well.

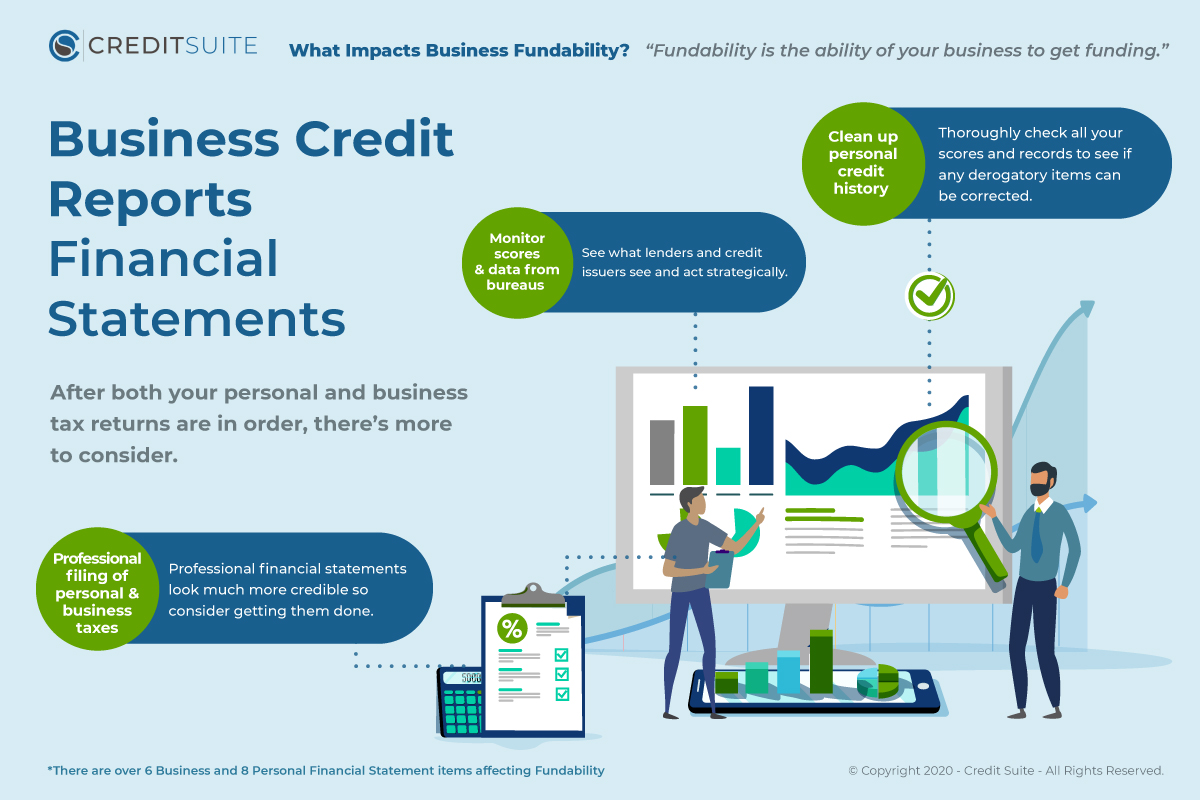

Business Financial Statements

A business financial statement includes a number of statements actually. At a minimum, most have a statement of income and expense, a balance sheet, and a statement of cash flows. Not surprisingly, they want to see that the business is profitable. With these reports, lenders can also make a number of calculations that will help them make decisions.

Typically, traditional banks have a credit analyst that does this. For new credit decisions, a credit analyst will compare financial statements for at least the past three years.

If they can get more financial history, that is even better. First, they will look for trends and patterns. Then, they will ask for explanations for major changes from one year to the next. For example, if there is a sudden increase in debts or expenses, or decrease in the bottom line, they will question that.

Audited Business Financial Statement vs. Company Prepared Financial Statement

This is why audited financial statements provide even stronger fundability. These statements will already have notes explaining any major fluctuation. Also, lenders view them as more reliable.

Of course, this makes it easier on credit analysts to make a recommendation and for underwriters to get their job done. Now, It does cost money to have financials audited. Yet, the fee is tax deductible.

Also, you can save money by making sure you are organized and prepared. Auditors typically bill by the hour, so the easier you make it on them, the less cost it is to you.

Business Financials: Ratios

Lenders also look at certain ratios to help determine creditworthiness. These are some of the most common ones used.

Current Ratio

First, the current ratio can help you understand whether a business will be able to meet obligations even if the unexpected happens. It is calculated as total assets divided by total liabilities.

Consider this example. If your business has $20,000 in assets and owes $10,000, the current ratio is 2:1. So, assets are double the amount of debt. As you might imagine, that looks good to lenders.

Quick Ratio

Another useful ratio is the quick ratio. This is similar to the current ratio, except it reduces total assets by total inventory. This is because you cannot turn inventory into cash immediately. It cannot really be used to pay obligations in the short term. If something happens and you need all the cash you can get from your assets immediately, inventory would not be part of that. For this ratio, a healthy number is 1 or more.

Debt-to-Worth Ratio

The debt to worth ratio is calculated as total liabilities divided by net worth. Net worth is simply total assets minus total liabilities. This ratio tells you, and lenders, how much you owe versus how much you own. In other words, how much of the business is really yours, free of debt.

The Big Picture of Fundability™

The financials of the business, and all that goes along with them, are just a fraction of what affects fundability. In fact, when you consider out of 125 factors, 6 of them are related to business financials—a good 4.8 %.

Also, business financials are not the only financials that affect fundability. Other factors include:

- Personal financials

- Personal credit history

- Data Agencies

- And bureaus

If you take all of these into consideration, you end up at around 27%, or about one quarter. The Fundability Codex below gives a good visual.

It’s important to note that not all Fundability factors are equal. Honestly, some do affect Fundability more than others. Still, it’s easy to see that there is much more to Fundability than just the business financial information. It’s true, having bad financials will get you denied by a traditional lender almost certainly.

But, having good financials doesn’t guarantee approval. Really, you need strong overall fundability. Are you wondering about the Fundability of your business? A free consultation with a business credit expert can help.