If you’re a business owner, you most likely realize you need an EIN. But how do you use the IRS website for EIN number?

Why is an Employer Identification Number so Important?

The Internal Revenue Service wants to be able to collect business taxes from your business. This nine digit number makes it possible for the IRS to match an official return to a business. To be able to prepare tax returns, you’ll need an official EIN. And tax returns can be a requirement for getting financing. Fortunately, you can apply for this vital number online.

Does Every Business Entity Need an EIN Number?

Before you start your EIN application, the United States government strongly suggests that you check your eligibility. Entities which must fill out EIN applications include:

- Sole proprietors

- Partnerships

- Corporations

- LLCs

Specific Eligibility

According to the IRS, You need an EIN for several reasons. The ones which directly relate to business credit building are:

- Started a new business

- Opened a bank account that requires an EIN for banking purposes

- Changed the legal character or ownership of your organization (for example, you incorporate a sole proprietorship or form a partnership)

- Purchased a going business

- Formed a corporation

The ones which do not directly relate to business credit building are:

- Hired or will hire employees, including household employees

- Created a trust

- Created a pension plan as a plan administrator

- Are a foreign person and need an EIN to comply with IRS withholding regulations

- Or are a withholding agent for taxes on non-wage income paid to an alien (such as an individual, a corporation, or a partnership)

- Are a state or local agency

- Are a federal government unit or agency

- Formed a partnership

- Administer an estate formed as a result of a person’s death

- Represent an estate that operates a business after the owner’s death.

Restrictions

The IRS will only issue one EIN to one person per business per day.

The IRS states,

“For entities with shares or interests traded on a public exchange, or which are registered with the Securities and Exchange Commission, “responsible party” is (a) the principal officer, if the business is a corporation; (b) a general partner, if a partnership; or (c) a grantor, owner, or trustor, if a trust. Except for government entities, the responsible party must be an individual (i.e., a natural person), not an entity.”

IRS Definitions

“For all other entities, “responsible party” is the individual … who ultimately owns or controls the entity or who exercises ultimate effective control over the entity. The individual identified as the responsible party should have a level of control over, or entitlement to, the funds or assets in the entity that, as a practical matter, enables the individual, directly or indirectly, to control, manage, or direct the entity and the disposition of its funds and assets.”

There are some differences if the applicant is a government entity.

Now that this is done, it’s time to walk through the process.

How to Get a Federal Tax Identification Number for Your Business

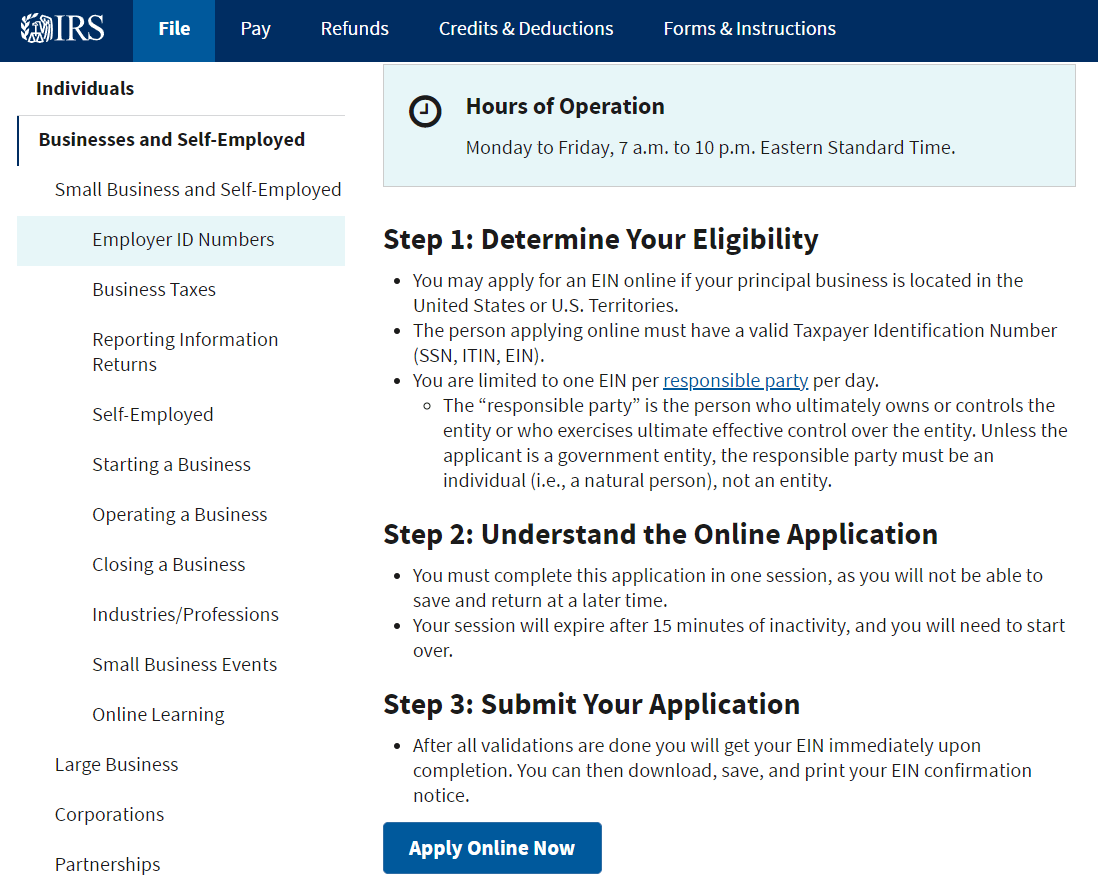

Start at the IRS official website and navigate to Apply for an Employer Identification Number (EIN) Online.

Determine Your Eligibility to Apply for an EIN

I highly recommend reading this page in its entirety. In particular, you will need to complete the entire form in one session. Therefore, be sure you have every single bit of information you will need. And, before you apply for an EIN, make sure you have incorporated your business. This may mean speaking with a lawyer well-versed in tax and/or business law.

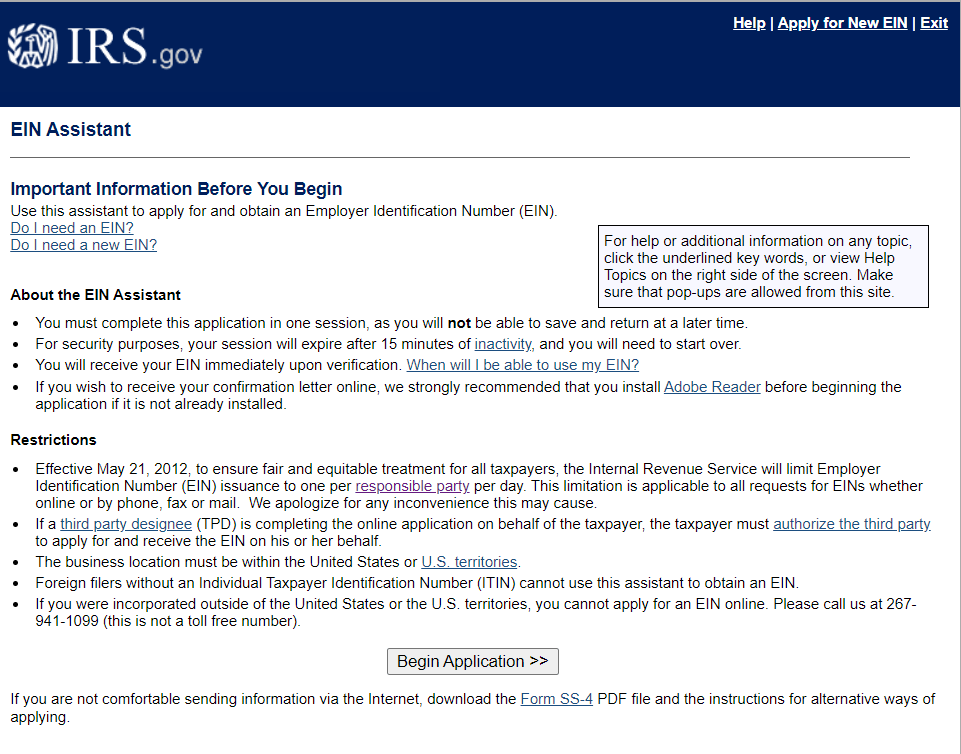

Click Begin Application

Begin Application

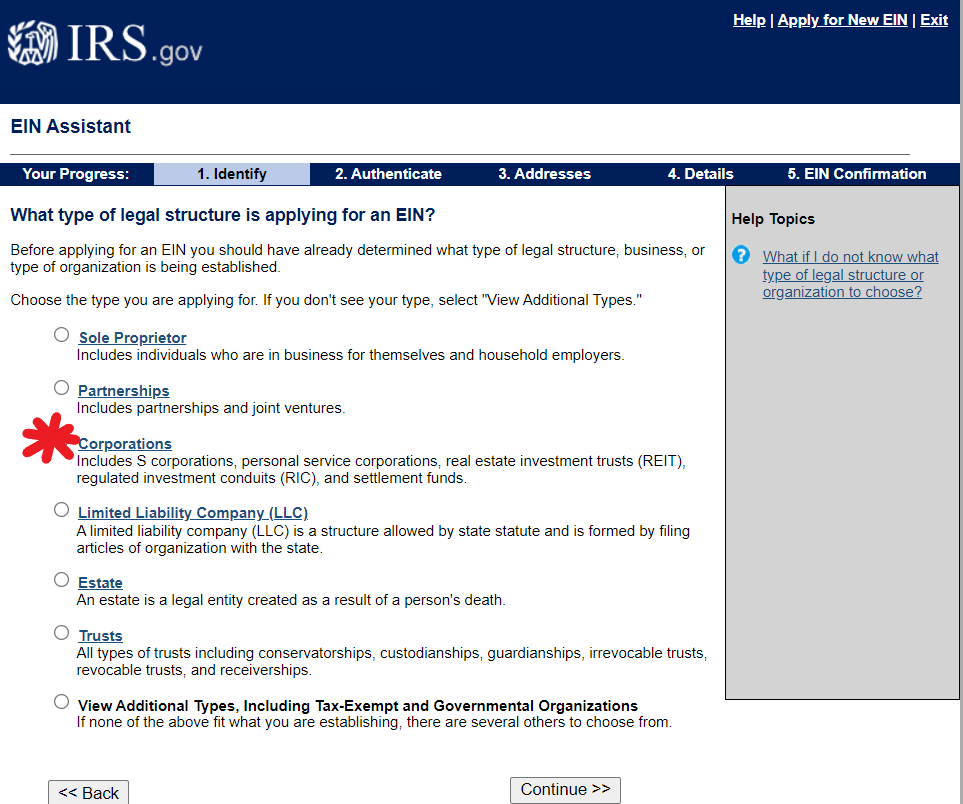

On this page, you’ll select your business entity. Even if you are a sole proprietor, the only real type of entity you can use to build business credit is a corporation of some sort.

Select Corporations and click Continue.

Corporation Selection Page

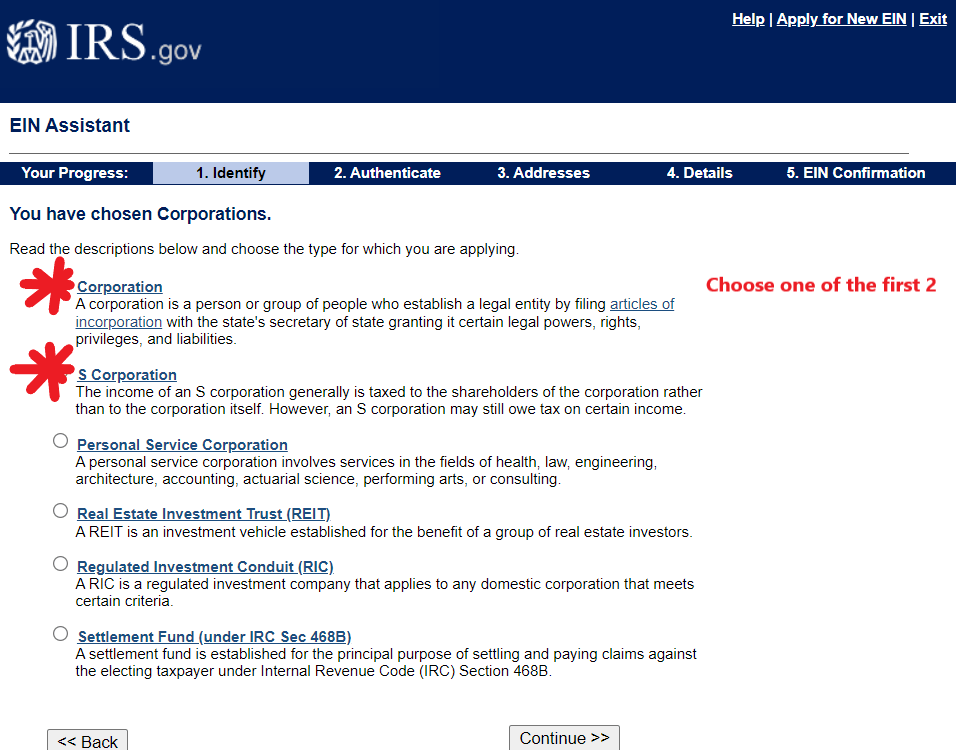

The IRS recognizes a few different types of corporations. But unless the applicant is the true principal officer/general partner for a personal service corporation (like a law firm), then they will be selecting one of the first two.

For a smaller corporation, usually an S corporation is best. But check with a lawyer or an accountant to be sure. In this example, I chose an S corporation.

Click Continue.

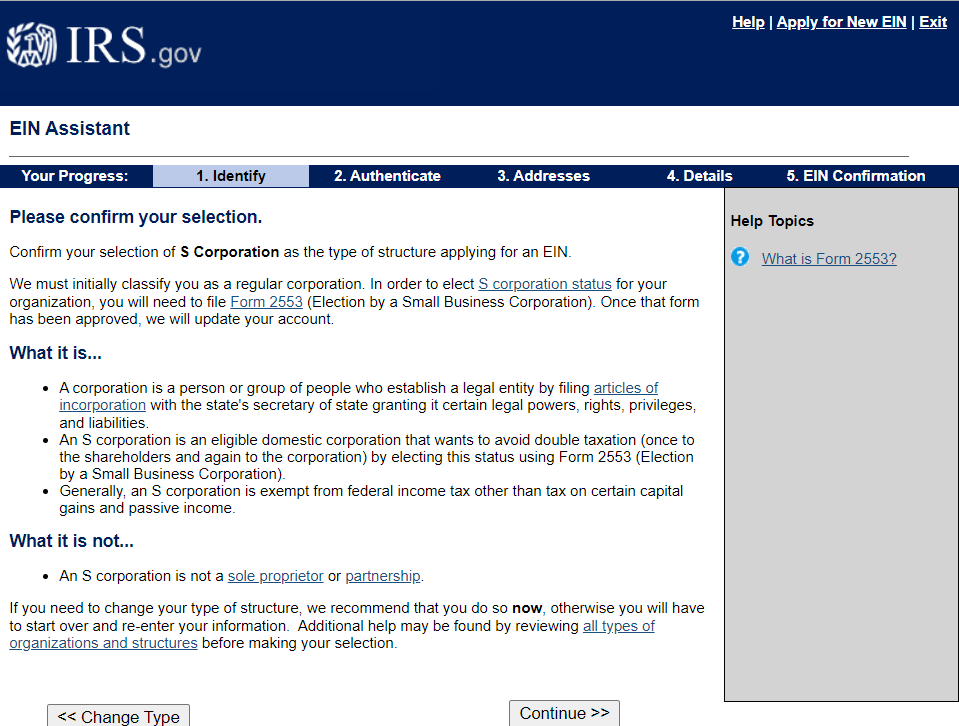

Corporate Selection Confirmation Page

The IRS wants you to be sure you know what you’re getting yourself into. If you’re unsure, click Change Type and go to the previous page and change your answer. And if you are sure, click Continue.

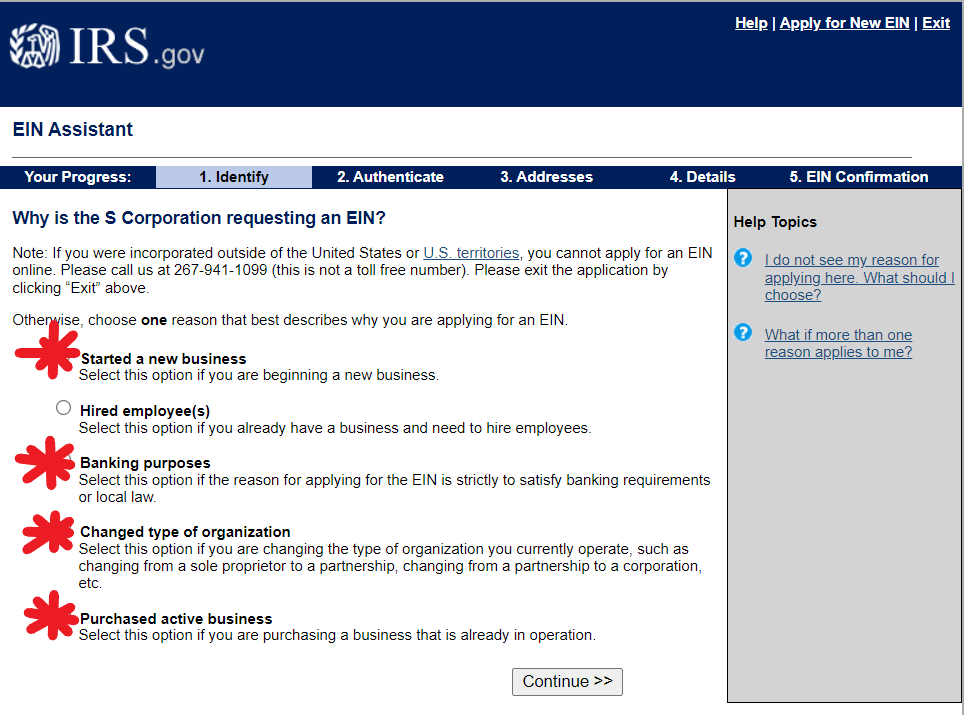

Reason for Requesting an EIN Page

In the next page, you’re asked why you even want an official EIN in the first place. Most companies building business credit will choose one of the four starred reasons.

Click Continue.

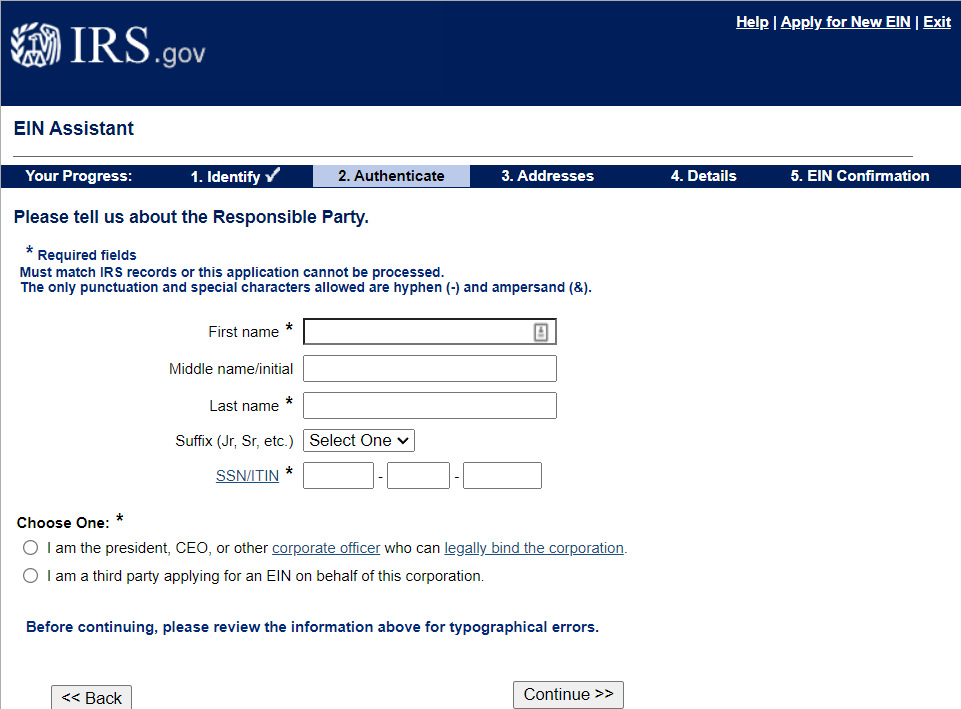

Add Details About the Responsible Party

Next, the IRS wants to know how to contact you or whoever will be responsible for the business. Provide name, etc. which must match the IRS’s records perfectly. If the record doesn’t match, the IRS may offer a means of correcting this data from a pop-up information menu. Always choose whatever the IRS says you should change this data to.

Click Continue.

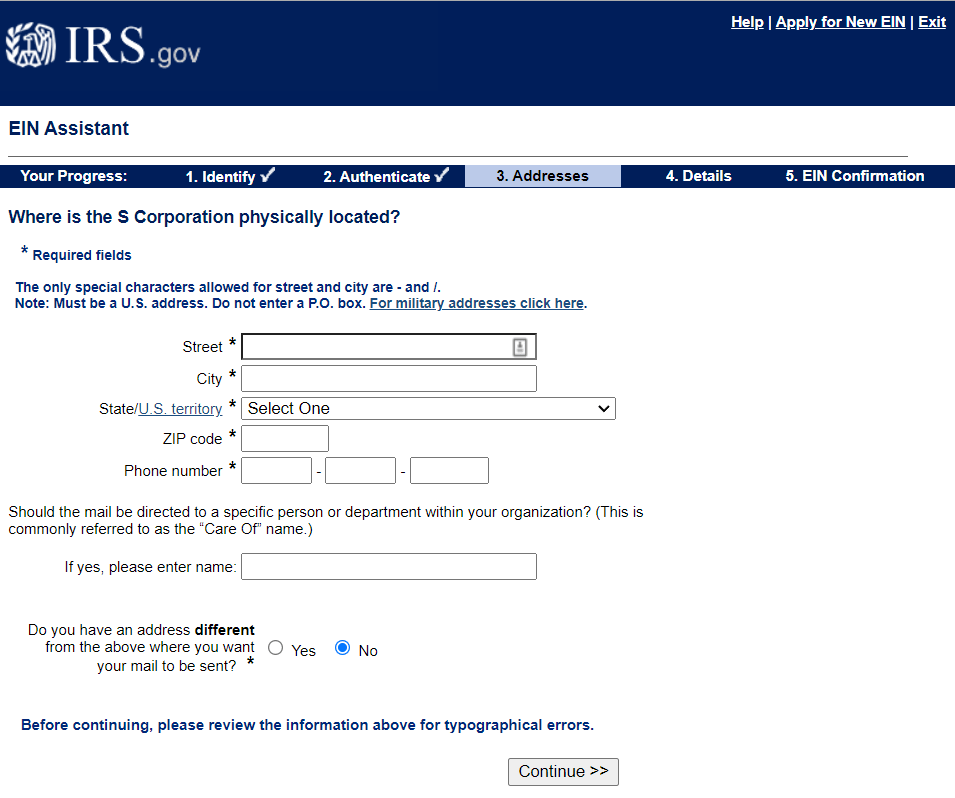

Add Corporate Address Details

One of the principles of Fundability™ is that your business must have a physical address which can accept deliveries. The IRS wants you to have one, too. Add details and accept any corrections the IRS may offer.

Click Continue.

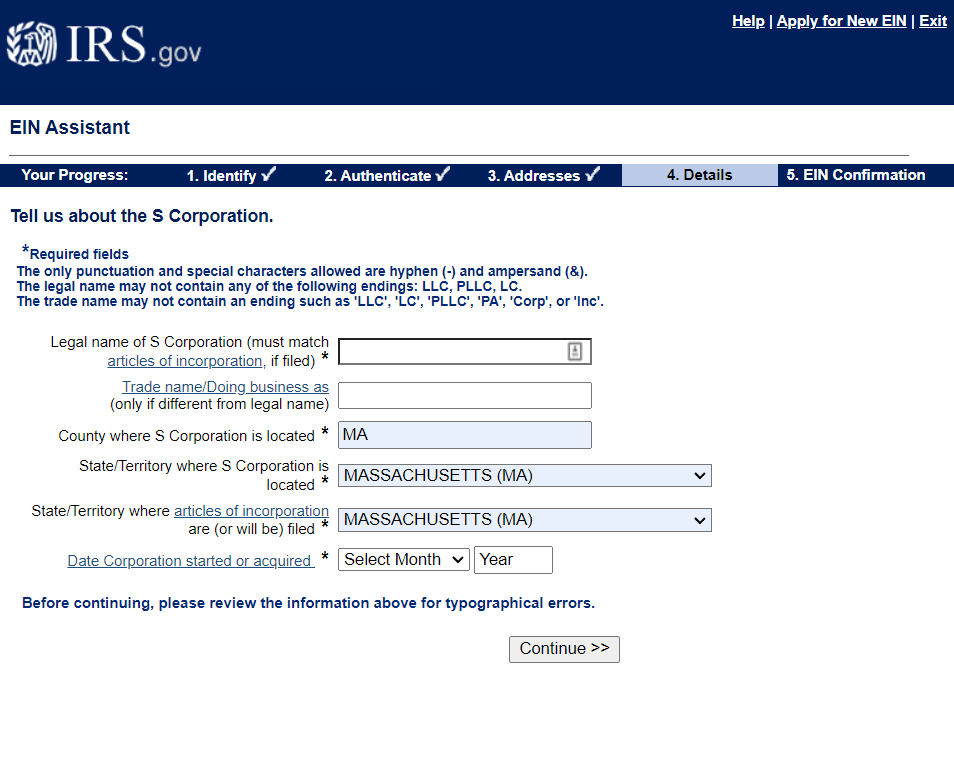

Details About the Corporation Itself

On the next page, add details like the name of the business. The IRS will pull the state directly from the address you added on the previous page.

Click Continue.

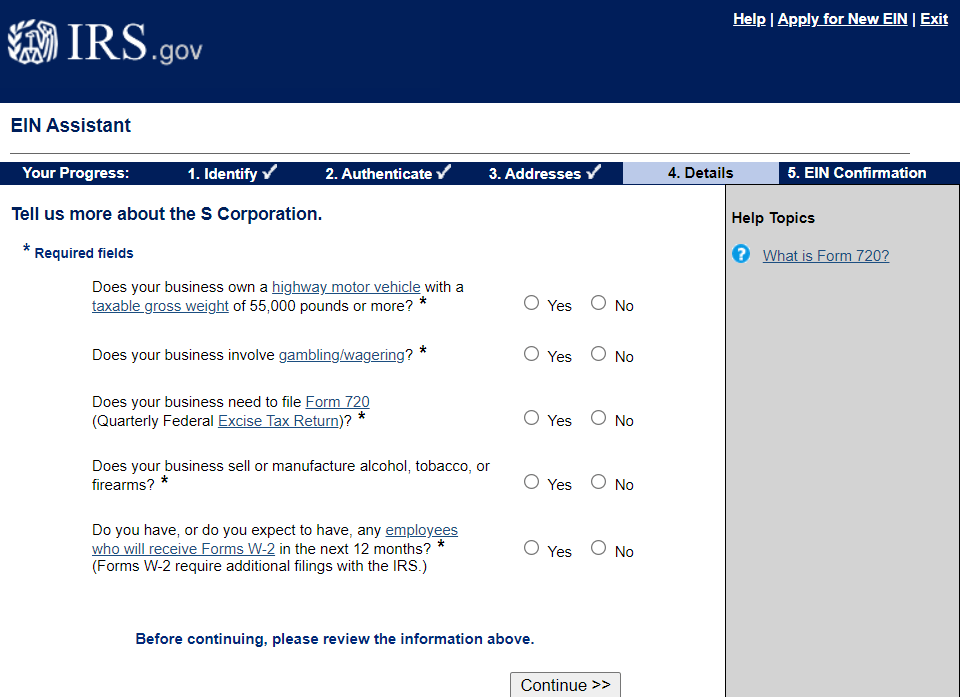

On the next page, add some more specific corporate details.

Click Continue.

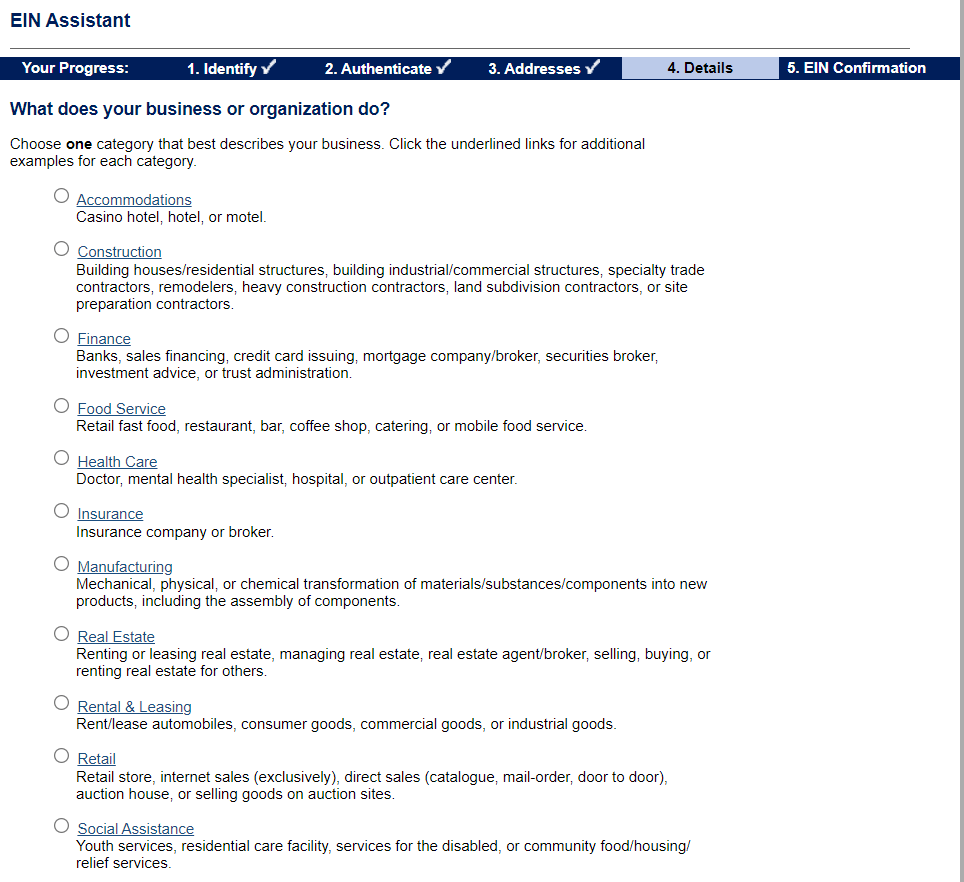

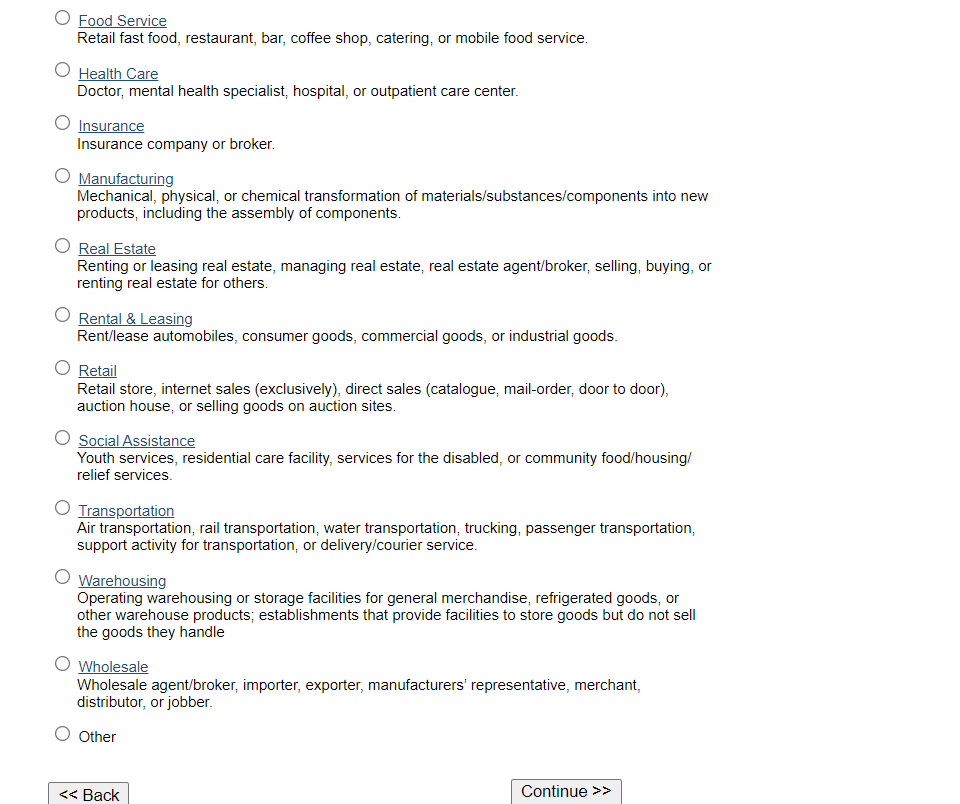

What Does Your Business Do?

Check the long list of possible industry types and see where your company best fits. For the purposes of this demonstration, I chose “Other”.

Click Continue.

Click Continue.

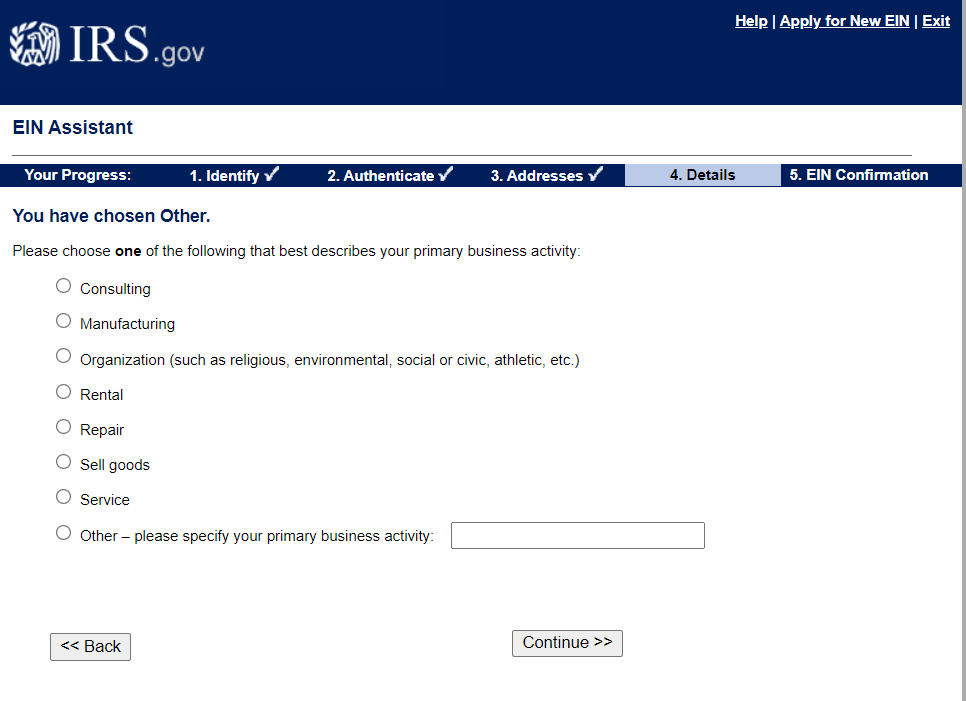

If you chose any industry but “other”, you most likely won’t see this page. But if you did choose “other”, you’ll need to elaborate. For the purposes of this demonstration, I chose “Consulting”.

Click Continue.

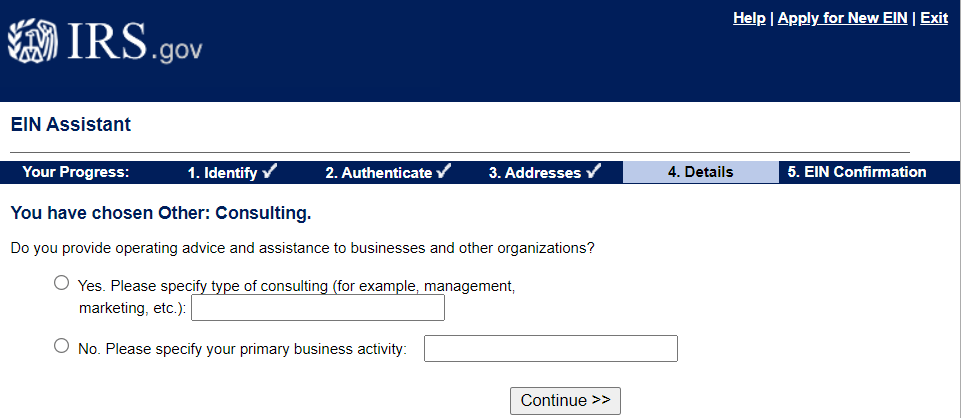

If you didn’t choose “Consulting”, then it’s likely you won’t see this page. But if you did select “Consulting”, add a bit more information.

Click Continue.

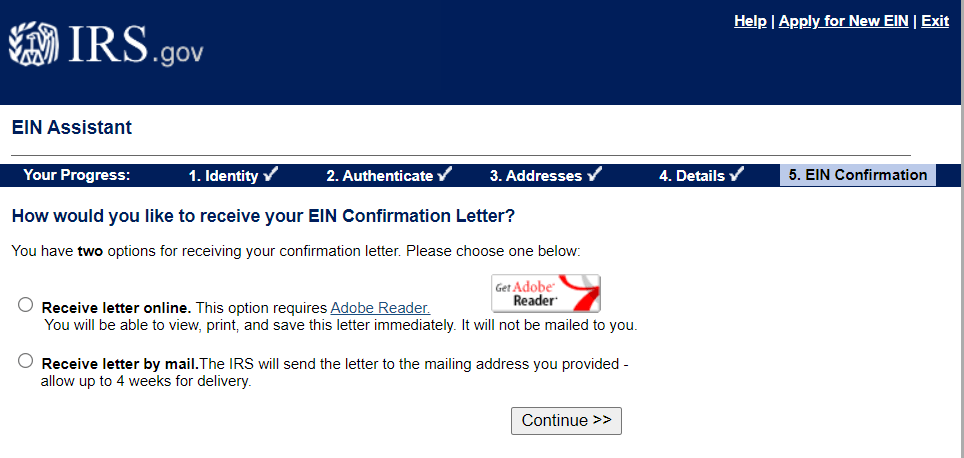

Choose How You Wish to Receive Your Employer Identification Number Confirmation Letter

I highly recommend going with the electronic option, as it is considerably faster.

Click Continue.

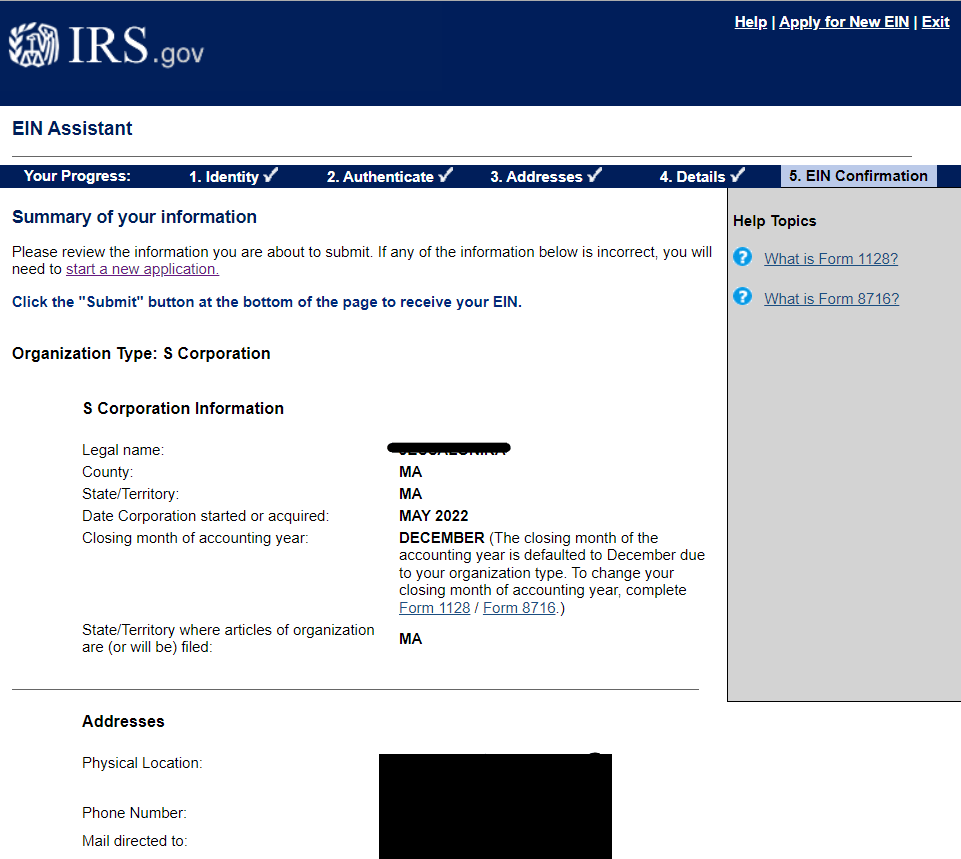

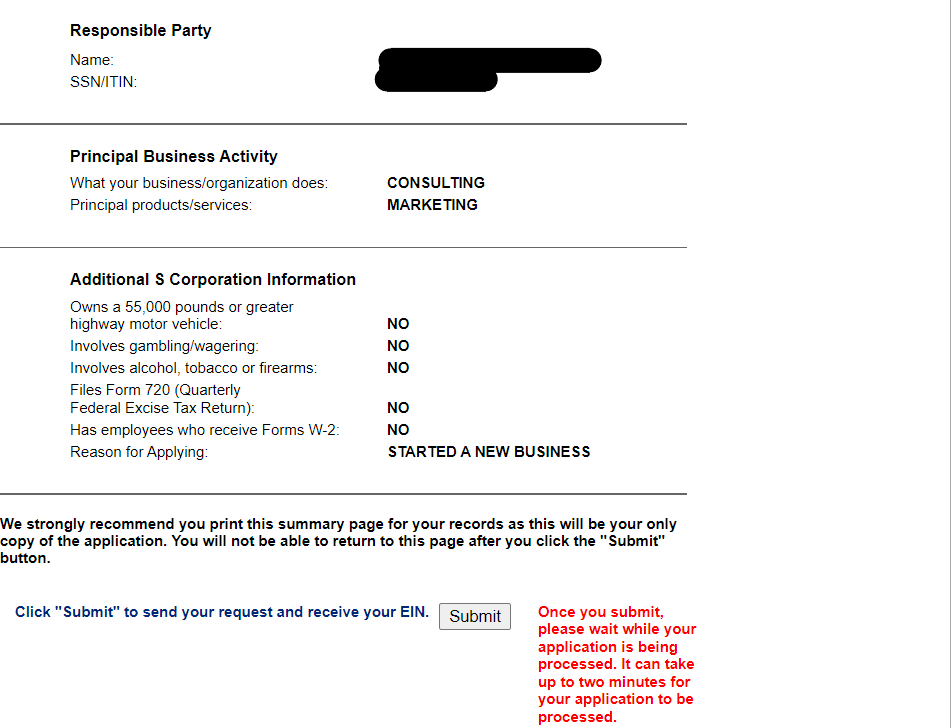

Confirmation of Entered Data

Finally, the official website of the Internal Revenue Service will show you your selections one last time, so you can be absolutely certain that you got everything correct.

Click Continue, and then you’ll get your valid taxpayer identification number.

Click Continue, and then you’ll get your valid taxpayer identification number.

Takeaways

So, one of the aspects of Fundability is a company’s ability to provide its tax returns. For many types of business financing, they are an absolute must. Follow the above steps and get your Employer Identification Number right the first time, every time. And be sure to contact us for your free business credit consultation, to get even more help for your business.