Have you ever heard of the Small Business Finance Exchange? If not, you need to. It could affect your business more than you may realize.

How the Small Business Finance Exchange is Changing the Way Lenders Do Business

The Small Business Finance Exchange is changing the face of business credit, and you need to know how. Solid business credit is essential to business growth. It is also important to the protection of your personal finances. Without a strong business credit profile, you will have to rely on your personal credit when it comes to business financing.

The Problems with Using Personal Credit to Finance a Business

This is bad is so many ways. It may not seem so if you have great personal credit. The problem comes when you do not have separate business credit. Then anything that affects your business affects your personal score.

If something doesn’t work out with the business, your personal credit score suffers. The percentage of your total credit used is important to your personal credit score.

If you use it to finance business expenses, even if you pay on time your utilization will increase. It will be hard to keep it below 30%, which is a killer to your personal credit.

It can work the opposite way also. A bad personal credit score can affect your ability to get business financing.

What You Can Do?

The remedy is to ensure your business has its own credit score. And be certain that score is complete and accurate.

The Small Business Finance Exchange, also known as the SBFE, helps with that. Certain lenders and agencies have access to their data. How do they get your information? How does it affect your business credit? And hw can it affect your ability to get financing for your business?

What is the Small Business Finance Exchange?

The SBFE is a not-for-profit entity that gathers data on small businesses from its members. The data is then used to compile comprehensive credit information. Lenders use this information to make credit decisions.

The Small Business Finance Exchange does not lend money. It also does not create or distribute credit reports.

How Does it Work?

They call the model they use a “give-to-get” model. Members provide information about their borrowers. In return they can receive information from the exchange. This information can help them make future lending decisions.

The process starts with members. The members report credit data from those companies that they do business with. This data will include payment history, among other things.

Next, the SBFE normalizes the raw data into usable information. It then distributes this data to certified vendors. These include credit agencies that have a partnership with the SBFE. The distribution to certified vendors is step three.

Details

Certified Vendors use the information to create comprehensive credit products. These products are for distribution to SBFE members only.

Members can request data on any small business to which they may extend credit. Since they gave information, they have information available to them. It’s like a trade of information.

Practically, this is what it looks like. A lender reports credit information about its current borrowers to the Small Business Finance Exchange. When a new potential borrower comes along, they request a credit report. This report does not come from the SBFE.

The request is to one of the credit reporting agencies such as Dun & Bradstreet or Equifax. Because of their membership with the SBFE, they receive an extended report. It includes the data sent by the SBFE as well as that from D&B.

How Does This Affect Your Business?

There is so much more to a business than how and when they make payments. Making consistent, on-time payments is essential. However, not doing so for a period of time does not always tell the whole story.

The Small Business Finance Exchange uses its data to paint a more complete picture so that credit issuers can be better informed.

Their mission is to be an advocate for the safe and secure growth of small business.

4 Ways The Small Business Finance Exchange Can Help Your Business

1. It Can Help You Build Fundability and Business Credit.

Strive to do business with SBFE members. When you do, you know your information is being reported. And that means you are building your business credit score. How do you know if your lender or vendor is a member? Ask them.

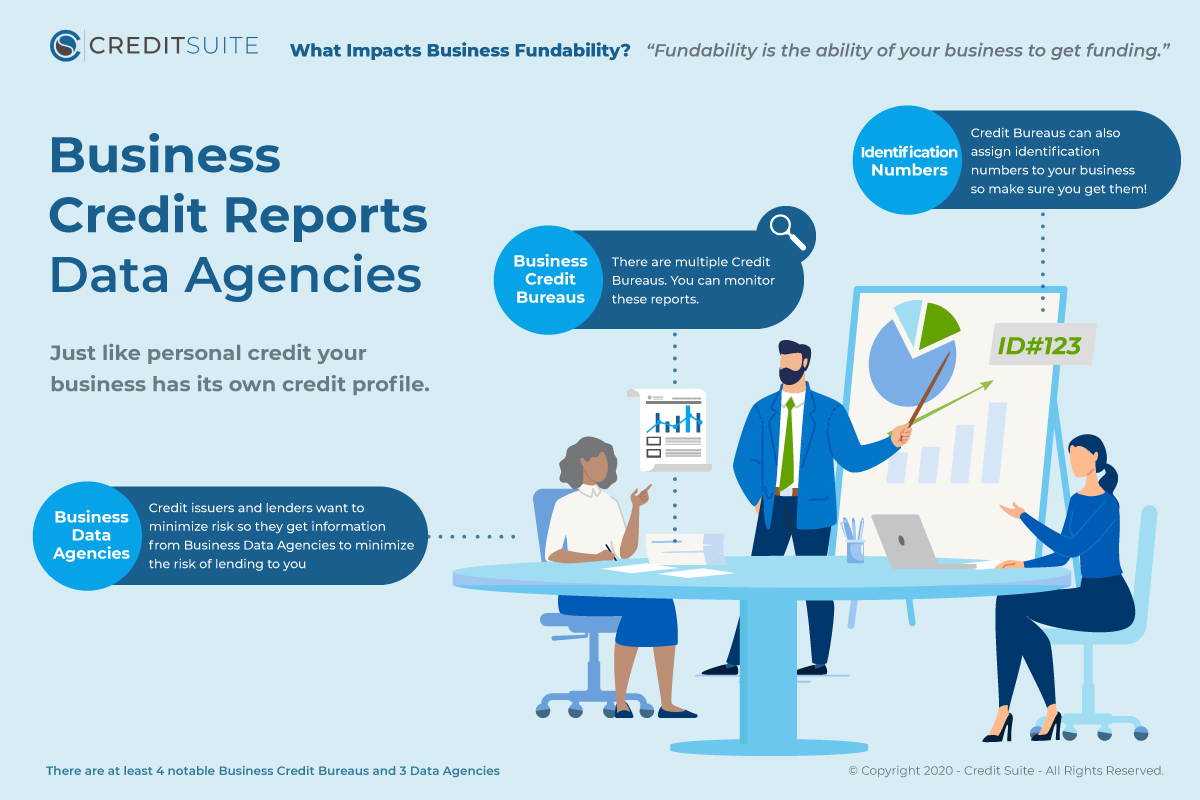

Not only that, but this is a business data agency. Business data agencies are one of over 100 factors that affect fundability. You want them to have more positive information than negative, both personal and business related.

If they are not, considered mentioning that they become a member. However, there are enough members in the network that it should not be hard to find one.

2. They Can Help You Grow Your Business.

By working with members, you ensure your information is being reported. Also, when credit issuers receive your information, you know they get a complete credit picture. If you are making your payments and working to build strong business credit, this can only help you.

3. You May Have Increased Funding Options.

The data available about your business from the Small Business Finance Exchange could open up additional funding opportunities that may not be available to you otherwise.

4. They Can Help You Make Wise Credit Decisions.

If you are a small business that lends money to other businesses and has the ability to report that information, you can join the SBFE yourself. You will gain access to information about borrowers available exclusively to members.

This information can help you make better decisions about your own business lending.

Who Can Become a Member?

Anyone who has the ability to report their small business lending information to the SBFE can become a member. The only way to gain access to the information that the exchange has in their Data Warehouse is to join.

Members include all types of lending institutions including banks, credit unions, and alternative lenders.

Certified Vendors

These are those agencies that have a partnership with the Small Business Finance Exchange. They distribute the data they receive from the SBFE. So they do this by creating credit analysis products using the information that the Small Business Finance Exchange provides.

They then report the data to members who request a credit report on a business that is included.

Certified Vendors include Equifax, Dun & Bradstreet, and most recently, LexisNexis Risk Solutions. Of course, Equifax and Dun & Bradstreet are credit reporting agencies. LexisNexis sells lending risk insurance products.

While other credit agencies are available to lenders, when they are a member of the SBFE and utilize one of these Certified Vendors, they get the benefit of the vendor’s own information plus that from the data received from the Small Business Finance Exchange.

Remember It Works Both Ways

As much as doing business with members of the exchange can help you, it can hurt you if you do not do things properly.

If you are doing business with SBFE members you eliminate the potential to not have any business credit. By default, members are reporting your information and therefore, you have business credit.

However, if you do not handle your business properly, the report members are getting about your business may not be favorable.

Members contract to report both positive and negative information.How Do You Know If Data Related to Your Business is In the Warehouse?

If you are doing business with member entities, your data is there. How do you know if the companies you do business with are members? Ask them.

What Kind of Data do They Have on My Business?

They have identifying information related to your business. This would include your business name, DUNS number, EIN, address, and NAICS code. That NAICS is a classification system used in North America. Your code designates your industry.

They also have both positive and negative payment information. Bills paid to vendors, suppliers and business partners on time or early are all included. It also includes bills paid late, or not at all, to suppliers, business partners, and vendors.

The limits on your credit accounts, payment information on lease payments, and credit card payment history are also included.

What Action Do I need to Take?

The Small Business Finance Exchange exists solely for the benefit of small businesses. They want to see these businesses thrive and grow, and one way they do that is by offering comprehensive credit information to those who lend them money to do so.

As a small business, you are responsible for your business credit. You control what information ends up on your credit report. So what can you do?

Details

- Pay your bills consistently on time

- Do business with SBFE members.

- If the businesses you currently do business with are not members, encourage them to join.

- Join the SBFE if you are eligible. (Remember you cannot self-report your own information, but by joining, you can make better credit decisions for your business.)

- Monitor your credit information.

A Word on Credit Monitoring

So there are a couple of ways to monitor credit. Remember though, that the Small Business Finance Exchange does not create or distribute any type of credit report.

You can request a report from one of the credit agencies such as Dun & and Bradstreet or Equifax. Even though they are members of the SBFE however, you cannot see that information specific to the exchange unless you are a member as well.

You cannot be a member unless you extend credit to small businesses.

We Can Help

You can also join a credit monitoring service such as the one offered by CreditSuite.com. This will give you continuous access to the information on your report, including your credit score and what is affecting it.

So use the information. Look for ways to build your business credit and report any mistakes. Send the agency a detailed explanation of what is incorrect, what the correct information is, and copies of all supporting documents available.

The Small Business Finance Exchanges Exists to Help Small Businesses

By offering a more complete credit picture to lenders, the SBFE ensures that more businesses have the financing available that they need to grow. As businesses grow, more businesses can be born. So it’s a win/win for everyone.

Do you have any experience with the Small Business Finance Exchange? Let us hear about it.