We investigated various small business lending statistics and trends and have compiled them to see if we could draw any conclusions about small business financing, success and failure rates, and the particulars of certain types of funding.

One of our bigger findings was that some of the classic elements of Fundability™, such as having a good personal credit history and a business plan, loom large for business failure and success, and the ability to get funding and loans.

Fundability™ is the life blood of businesses.

1. Percentage of Small Businesses That Applied for Loans

Per Fed Small Business, 59% of small businesses (employer firms, not nonemployer firms) applied for a loan in 2023. Businesses turned to online lending institutions, the Small Business Administration, merchant cash advance providers, and institutional lenders (namely, large banks and small banks).

Most businesses sought out a loan, line of credit, or merchant cash advance, with credit cards and trade credit being the next most popular sources of financing option.

43% of applicants sought out a business line of credit, with 36% seeking out a business loan and 20% seeking out an SBA loan or line of credit.

But where did businesses fare best? Which loan type was the best?

73% of those who applied for an auto or equipment loan were fully approved, with 54% being fully approved for their mortgage or real estate loan and 46% being fully approved for a business line of credit.

Financing approval rates based on where applications were placed can tell us a lot as well.

Businesses had the most luck with being fully approved at small banks, credit unions, and finance companies. 52% of applicants at small banks were fully approved. Small businesses saw an equal 51% full approval rate at both credit unions and finance companies.

2. Percentage of Businesses That Fail Because of Insufficient Capital

Data from the U.S. Bureau of Labor Statistics reveals that approximately 20% of businesses fail annually, something that has remained consistent up to most recent reports in 2023. Why is this?

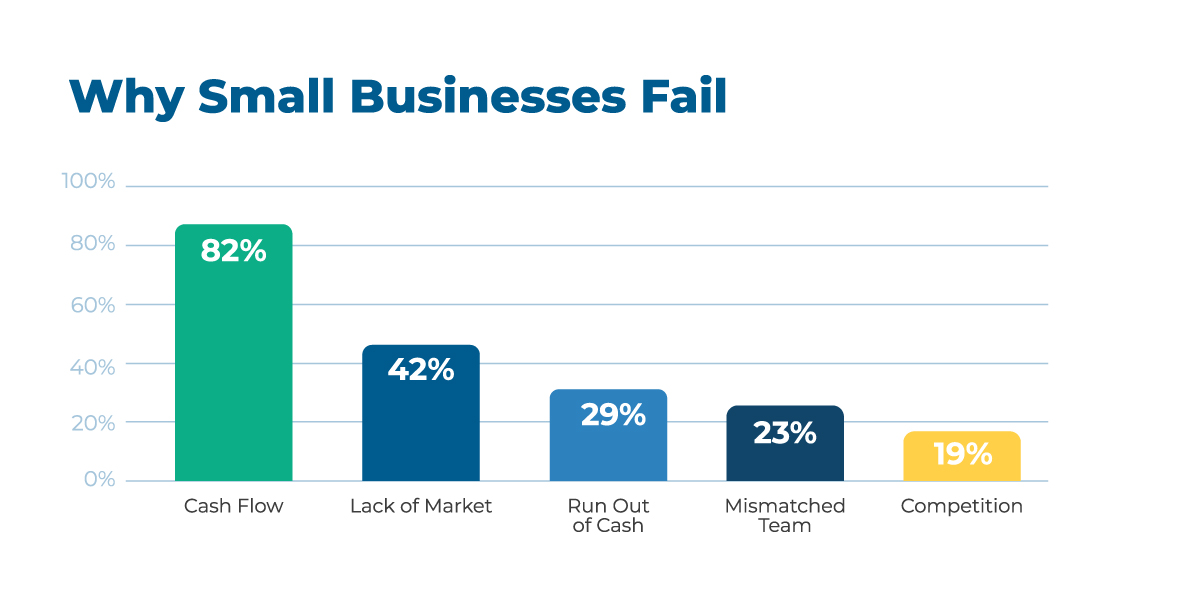

As per data found at Business Insider, 82% of small businesses fail due to cash flow problems, 42% due to lack of market, 29% run out of cash, 23% due to having a mismatched team, and 19% are because of competition winning.

These numbers equal over 100% due to, most likely, allowing multiple answers to the question.

These numbers reflect tracks leading directly to business failure. With some statistics pointing to not having money, either enough or when a business truly needs it. While others are not performing a true market analysis to determine if there’s a need for the product or service.

According to the Fed Small Business report mentioned in the previous section, the major financial challenge small businesses encountered was that 77% of firms experienced challenges with rising costs.

Meanwhile, 52% struggled with paying operating expenses, 49% struggled with uneven cash flow, 44% struggled with weak sales, 34% struggled to make payments on debt, and 29% struggled with credit availability.

These issues can be averted, at least in part, by small business owners putting together a classic business plan or at least answering many of the questions which go into producing one.

3. Average Debt Held by the Average Small Business

Many small businesses carry debt. In fact, it is a good form of financing, and we highly recommend it here at Credit Suite.

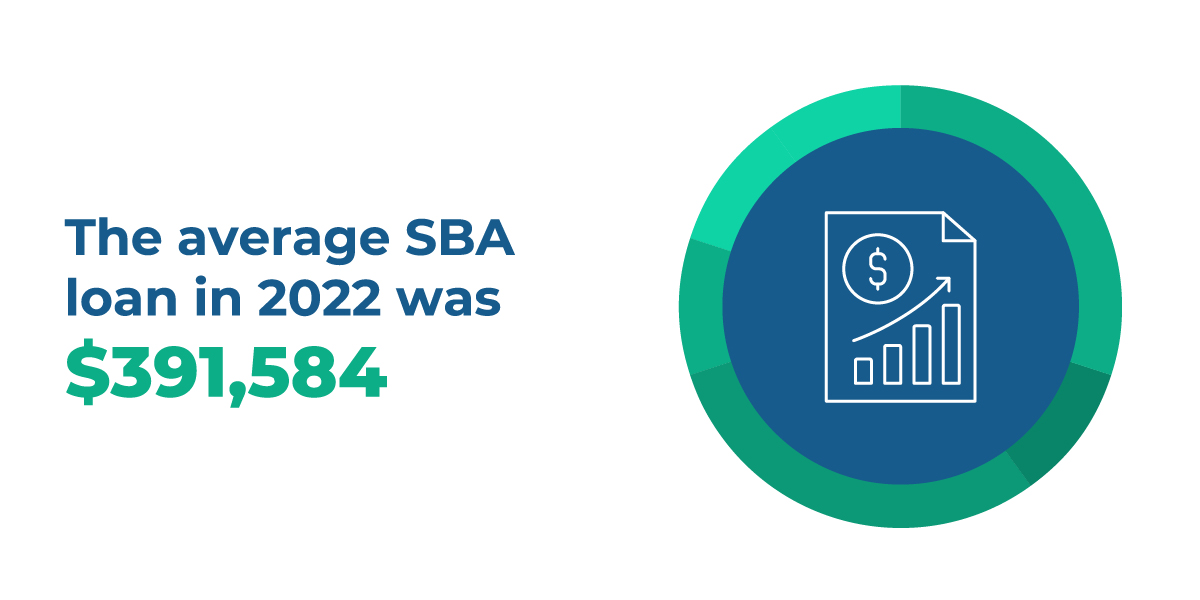

Per LendingTree, the average SBA loan in 2023 was $391,584. Data recorded by the SBA through March of 2024 showed a mid-year average of $458,584. We’ll get a better picture of the average SBA loan with data for the full year.

Per Yahoo, 70% of small businesses carry some degree of debt with a total of $18 trillion owed by the end of 2022. But that amount fluctuates year-to-year.

Since only about a third of all small businesses will make it to their tenth year anniversary, it’s fair to say that a number of these debts will not be paid off, at least not in full.

4. Percentage of Businesses That Had Their Loans Denied

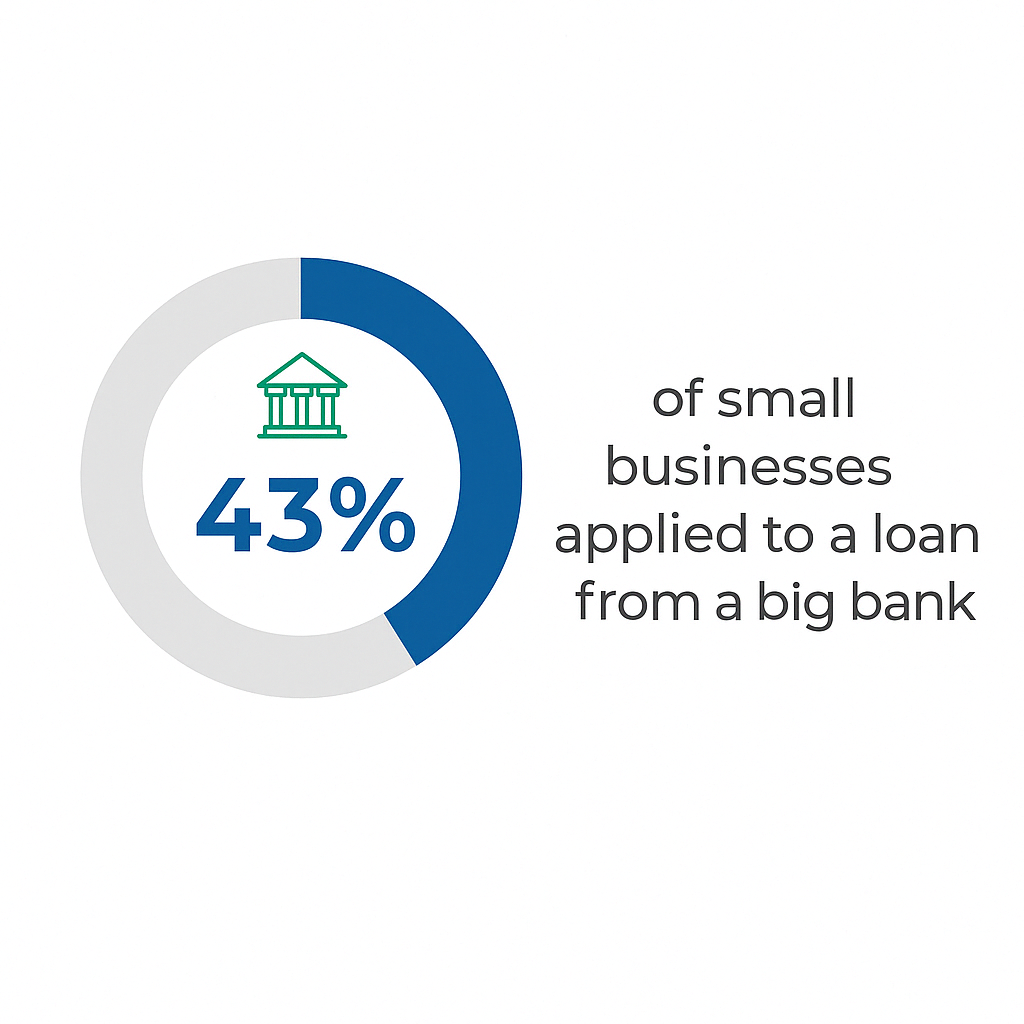

According to Deskera’s 2020 key findings, 42% of small businesses applied for a loan from a big bank. In contrast, Finder reports that 43% applied to smaller banks in 2020.

But the Fed Small Business 2024 Report on Employer Firms summarizing findings from the 2023 Small Business Credit Survey paints a much more comprehensive picture of what denial looks like now.

According to Fed Small Business, the denial outcomes for loan, line of credit, and cash advance applicants were as follows:

- Auto or equipment loan: 9%

- Mortgage/real estate loan: 18%

- Business line of credit: 27%

- Home equity loan or line of credit: 32%

- Personal loan: 33%

- Business loan: 35%

- Merchant cash advance: 18%

- SBA loan or line of credit: 42%

They also offer data on denial rates by source. The following is the percentage of applicants denied by funding sources:

- Small bank: 25%

- Credit union: 24%

- Finance company: 24%

- CDFI: 32%

- Large bank: 34%

- Online lender: 30%

5. Average Credit Score for Loan Applications

According to a 2018 survey by the FDIC, large banks were more likely to use owner FICO score as a criterion for lending than a small bank was. https://www.fdic.gov/resources/publications/small-business-lending-survey/2018-survey/index.html

Per FinImpact, the average FICO score for business owners overall (that is, both loan applicants and not) is 721.

As a result, the average owner has a better FICO score than the majority of Americans. A score of 721 puts them above the national average of 673 by a good 48 points.

However, despite such a good score, business owners have a larger debt load than the average American citizen. As you may expect, this is largely due to the expenses of starting a business.

6. Percentage of Businesses Getting the Entire Loan Amount They Applied For

According to the Federal Reserve System’s Small Business Credit Survey, “Approval rates on loan, line of credit, and merchant cash advance applications were mostly steady between 2022 and 2023. The share of applicants fully approved remains below prepandemic levels.”

Full approval for each loan type in the 2023 survey revealed the following trends for small firms:

- Auto or equipment loan: 73%

- Mortgage/real estate loan: 54%

- Business line of credit: 46%

- Home equity loan or line of credit: 44%

- Personal loan: 38%

- Business loan: 38%

- Merchant cash advance: 35%

- SBA loan or line of credit: 34%

Continuing with their findings, “Financing approval rates were highest at small banks, credit unions, and finance companies. Online-lender applicants were least likely to be fully approved… Applicants at finance companies and small banks remain more likely than applicants at large banks and online lenders to be approved.”

Full approval breakdown by source looks like this:

- Small bank: 52%

- Credit union: 51%

- Finance company: 51%

- CDFI: 46%

- Large bank: 44%

- Online lender: 31%

The survey found racial discrepancies in the amounts of financing received as well. In 2023, 56% of white-owned applicant firms got all the financing they sought. Compare this with 32% of Black-owned firms, 34% of Asian-owned firms, and 32% of Hispanic-owned firms.

Currently, after the pandemic, industry has become a more important factor in financing success. In 2021, the share of leisure and hospitality firms receiving all of the financing sought fell to 20%. Yet 47% of manufacturing firms received the full amount.

7. Reasons for Funding

In 2023, according to the Fed’s Small Business Credit Survey, 59% of all businesses sought financing (particularly credit) in order to meet operating expenses.

Note: businesses were able to choose more than one answer.

In contrast, a 2024 report by the FDIC on their findings from the 2022 Small Business Lending Survey (banks were able to select more than one answer in the Small Business Lending Survey), revealed that terms loans and lines of credit were the most popular funding solutions utilized by small businesses.

According to data from the Small Business Lending Survey:

- Small term loans of $25,000 were most commonly used for the purchasing of equipment (65% reported this application of smaller loans).

- Large term loans of $1 million or $3 million were primarily used for owner-occupied commercial real estate (CRE) (81%).

- Medium term loans were used (for the most part, equally) for equipment (36%) and CRE (42%).

- Lines of credit are typically used for liquidity purposes.

- All sizes of loans are mostly used for working capital, inventory, and funding of accounts receivable

- A quarter of banks report using large lines of credit for owner-occupied CRE.

It’s important to note that all data in this report is subject to certain conditions.

As it pertains to the data provided above, the FDIC states, “Responses were combined to form the “large loan” category. Banks that made $3 million loans were asked about their $3 million loans, whereas

banks that made $1 million loans but not $3 million loans were asked about their $1 million loans. Question is keyed to the bank’s highest-volume

small business lending product, excluding credit cards and government-guaranteed products…”

8. Percentage of Businesses With Outstanding Debt

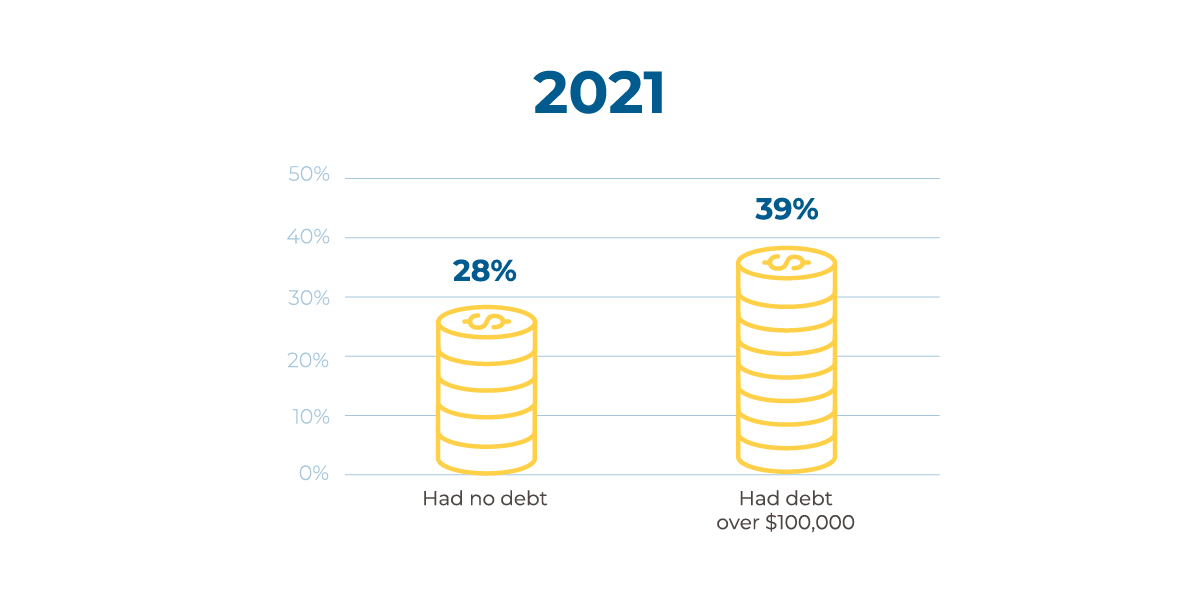

According to the Fed Small Business 2023 survey, the number of businesses with no outstanding debt went down from 2018 to 2023.

In 2023, as per the survey, about 28% of businesses had no debt. This number sat at about 30% in 2018, dropped sharply to 21% in 2020, rose up to 26% in 2021, and then remained at 28% for 2022 and 2023.

32% of businesses had less than or equal to $100,000 in debt. This figure sat at around 38% back in 2018.

39% of businesses had more than $100,000 in debt in 2023. This figure was at 32% in 2018, a considerable rise in comparison to the other data points regarding outstanding debt.

At the time of the survey, 28% had an outstanding balance on an EIDL loan.

9. Average Interest Rates

This is going to depend on which bank, program, or administration the loan comes from. For example, as per Bankrate, SBA interest rates range between 10.50% to 16.25%.

But interest rate issues changed during the pandemic. According to Finder, thirty-two percent of business owners applied for a loan in order to refinance or pay down debt in 2020, in contrast to 30% in 2019.

As per the 2023 Small Business Credit Survey, this number fell a little, reaching only 24% of businesses looking to refinance or pay down debt.

But rates are rising, so refinancing has become a less attractive option for a small business.

On the other hand, per Zippia, rising rates are making small business lending more profitable for lending providers. Hence, we may see more approvals or at least more applications.

And if a lending provider can swing a long term loan for a borrower (say, for the length of a standard mortgage), and the amount is for something like half a million dollars, the amount of interest paid would top $1 million easily.

10. Total Number of Loans Distributed By SBA and the Average SBA Loan Size

Per Chamber of Commerce, “The SBA distributed over 14 million loans worth $764 billion to small businesses in 2020.”

According to Investopedia, $500 billion of it was a result of COVID-19 relief.

This means that a good 96% of the loans distributed by the SBA in 2020 were just for COVID-19 relief. And while SBA loans can go as high as $5 million, the average for SBA loans is $417,316.

The reason for the lower average is, potentially, due to the fact that a loan of over $25,000 is going to require collateral. Also, business owners may not have had good enough cash flow and/or personal credit to qualify for higher amounts.

Or, business owners may have opted for microloans or requested lower amounts, due to a fear of not being able to get an approval.

Owners may have also relied, instead, on the Paycheck Protection Program as, according to FinImpact, the PPP provided 5.2 million loans worth more than $669 billion.

Has this changed much in recent years? Per LendingTree, the number of approved SBA loans has shrunk significantly. Only 106,534 SBA loans worth a total of $41,717,020,929 were approved, with the average loan amount sitting at $391,584.

While full data for the year 2024 isn’t available yet, 40,227 SBA loans worth $18,447,451,624 were approved by March of 2024, with the average loan amount being $458,584.

11. Percentage of Small Businesses That Fail

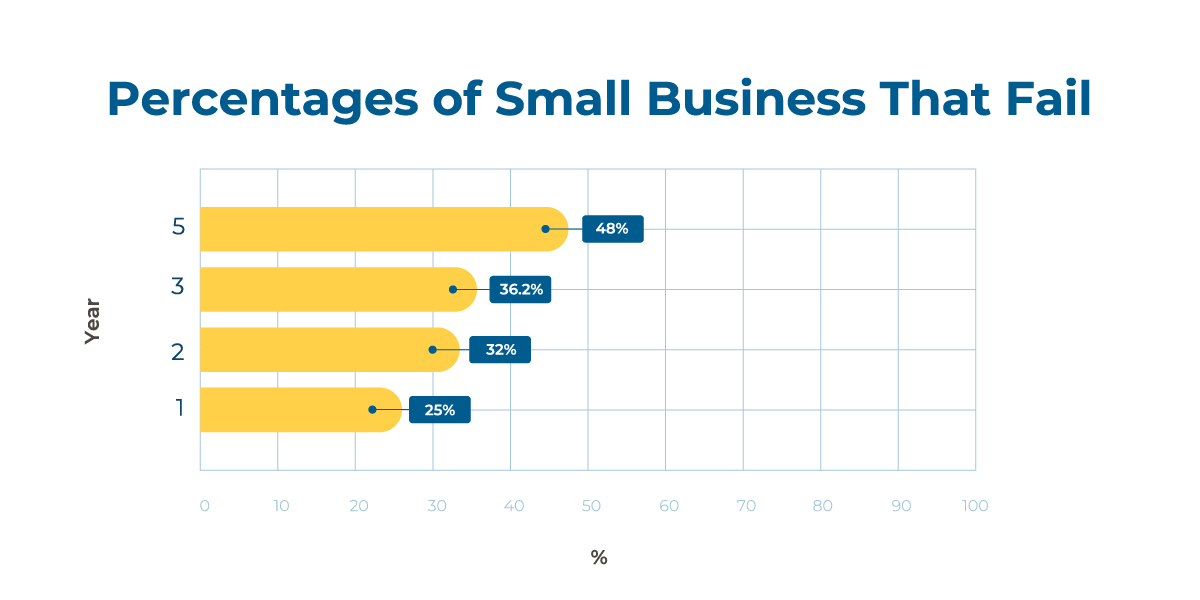

Per LendingTree (using data provided by the U.S. Bureau of Labor Statistics), about one in 4 businesses fail within the first year. After two years, this number jumps up to 32.8%. Failure rates at three, four, and five years are 36.2%, 43.2%, and 48%, respectively.

After six years, the failure rate exceeds 50% and keeps growing.

Essentially, the hardest years are the first three to five. Once a business gets past the six year mark, it isn’t necessarily smooth sailing. But the chances of failing do drop.

By the time a business has weathered its first half-decade, a small business owner has, presumably, learned from their earlier errors. By this time, a small business has likely been able to build something of a business credit score.

A better score, coupled with more time in business, can make loan approvals more likely. More access to capital is also going to raise success rates for small businesses, making this stat a bit like the chicken and the egg.

Do older businesses succeed because they’re older? Or do they succeed because being older opens up more opportunities for funding, alternative lenders, or otherwise?

12. Average Bank Loan Size

According to small business statistics from FinImpact, the average size of all business loans was $107,000 in 2017. The average small business loan mainly came from larger banks. Businesses looking for larger loans tended to go for bank lending.

These larger loans were also more often to be commercial bank lending.

But more than half of all business loan applicants applied for $100,000 or less. Smaller banks, online lenders, and peer to peer marketplaces were popular for smaller loan amounts.

By 2020, as the effects of the pandemic started to really ripple across the small business community, the average bank loan climbed to $108,000.

With the PPP program over, and the Federal Reserve Bank taking over failing banks, not as many entrepreneurs are going to want to fill out a small business loan application.

While we’re lacking recent data about average loan sizes, we do have more recent data regarding SBA loans specifically. As per Lendio, the average SBA loan amount in 2023 was $479,685.

13. Percentage of Businesses That Use Loans to Acquire New Assets

As per the Small Business Credit Survey, 46% (of the 59% seeking funding) were looking to expand business, pursue new opportunities, or acquire business assets. This is a considerable number of businesses solely seeking funding to acquire new assets and scale.

But that begs the question, what were businesses seeking funding for if not for the acquisition of new assets?

As data shows, 59% wanted to meet operating expenses. 41% were looking to have available credit for future use as needed. Having the extra financial resources you need when scaling demands can be beneficial to your small business’s growth.

28% were looking to make repairs or replace capital assets, and 24% were looking to refinance or pay down debt. Most businesses seeking funding want to acquire new assets, but there are many other reasons for businesses to approach traditional banks or alternative lenders to secure loans.

Respondents in this survey could select multiple answers in regard to loan demand and funding goals. Some respondents may have wanted funding for several purposes.

14. Loan Approval Rate by Big Banks

An entrepreneur (like those running women owned businesses) might look to a financial institution like a large bank or online lender for funding, but the approval rate is not going to be the greatest with commercial banks.

As per Fed Small Business, in 2023, only 44% of applicants received full loan approval from larger banks while 22% were partially approved. But small companies had some options and there were ways to improve the numbers.

Small banks were a great choice because as of 2023, the full loan approval rates were around 52% and partial approval rates were around 25%.

Businesses turning to a credit union or a finance company would see a better percentage than at large banks. The full approval rates of credit unions were only 51%, with partial approval rates sitting at 24%. Approval rates were roughly the same for finance companies.

Collateral was one great way to increase a small business’s chances at a loan. Small business loans like equipment loans had higher approval rates, at 73% for full approval and 18% for partial approval.

Working with the SBA was another, but the SBA was no guarantee of loan acceptance, as SME lending providers only fully approved about 34% of small business loan applications and partially approved 25%. They rejected nearly half of all small enterprises seeking funding.

Takeaways

The pandemic threw a wrench into a lot of entrepreneurs’ plans for their small businesses. The average small business owner was more likely to try to borrow funds in order to survive or to pay down debt.

But as times change and the Fed keeps on increasing rates of interest, small business finance will change along with it, and entrepreneurs may be more inclined to borrow in order to go past surviving and start thriving.