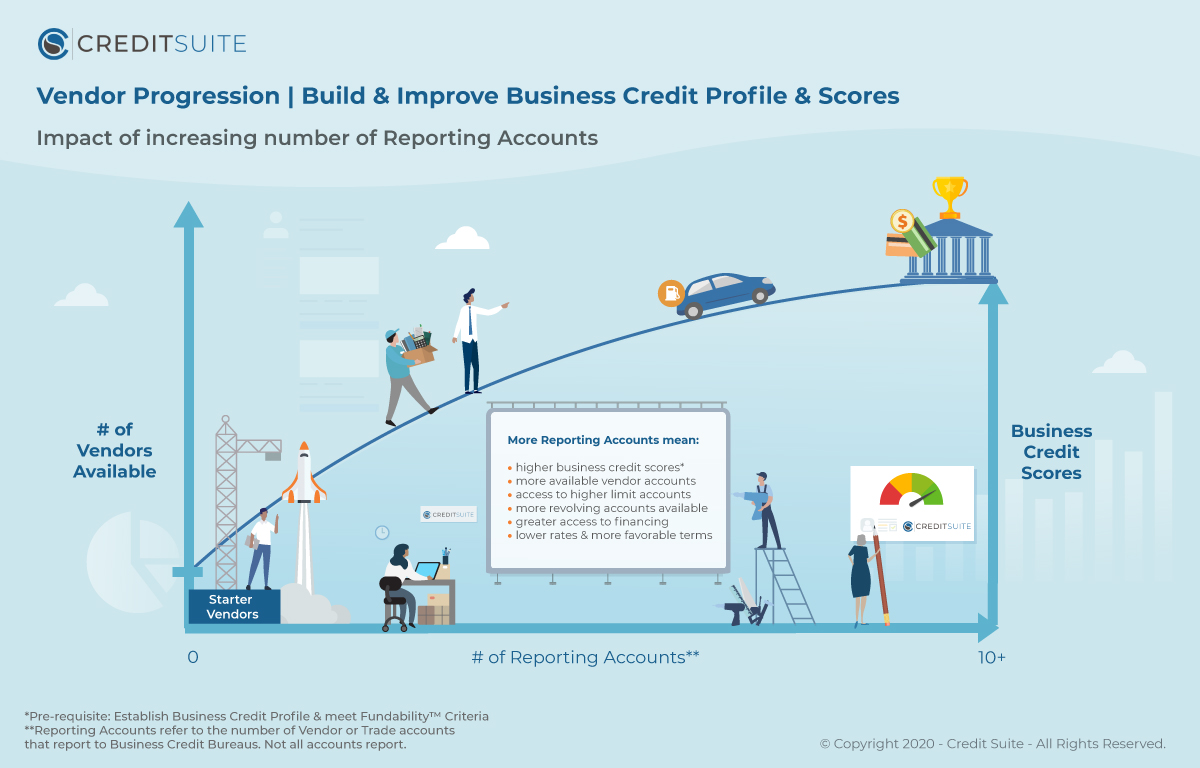

List of Tier 1 Business Credit Vendors

We compiled this list tier 1 business credit vendors so that you don’t have to. Almost all of them report to the business credit bureaus, and they accept just about any business! Read on for more details on each one.

Note: Business credit vendor terms can and do change. Currently, Office Depot and Office Garner are Tier 2 vendors. Summa Office Supplies and Business T Shirt Club are Tier 3 vendors. We made adjustments to our list accordingly.

We list Wise Business Plan as a non-reporting account. In the past, they had reported to Credit Safe.

And keep in mind: we don’t list these vendors just because you can build a business credit profile with them. We also list them because you can get office supplies and other necessities for your business, from vendors which provide exceptional customer service.

Business credit building is more than a means to an end. It is also a form of business financing, and can lead to other kinds of funding like a credit line or cash flow financing or commercial credit lending—all for the cost of necessary business supplies!

1. eCredable

Our first starter vendor account is eCredable. You can build business credit by reporting your business utility, telecom payments, and many other qualifying business bills. We really like eCredable because it builds your business credit with the bills that you’re already paying. So you can get many different vendor tradelines with only one account!

This vendor reports its subscription payments to D&B, Experian, and Equifax. Dun & Bradstreet only accepts the eCredable Business Subscription payment at this time. But your other bills do get reported to Equifax.

You will be charged a $49.95 one-time setup fee immediately. Then you’re charged $9.95 for each month that you continue your subscription.

Note: if your service provider does not have online access, or you do not have an online account setup with your utility company, eCredable cannot link your account and automatically update your monthly payment history.

Their qualification requirements are:

- Being an entity in good standing with Secretary of State

- An EIN

- Business address (matching everywhere)

- D-U-N-S number

- Business license (if applicable)

- A business bank account

Apply online; credit terms are that this is a tradeline payment.

2. Grainger Industrial Supply

Our first net 30 account is Grainger Industrial Supply. This vendor sells hardware, power tools, pumps and more. They report to Dun and Bradstreet and Equifax. There is no personal guarantee necessary to get net 30 terms for trade credit with them.

If a business hasn’t yet started to build business credit they will want to see other information like accounts payable, income statement, balance sheets, etc.

They offer net 30 terms, and qualification requirements include:

- Being an entity in good standing with the applicable Secretary of State

- Being registered with the Secretary of State (SOS) for at least 60 days

- An EIN

- A business address that is consistent everywhere it is listed

- A D-U-N-S number

- All business licenses (if applicable)

- A business bank account

There is no minimum order to report, but this net 30 account prefers for a small business to have at least a $50 payment history.

You can apply online or over the phone. Read our full Grainger net 30 review here.

3. Uline

Our next net 30 account is Uline. Uline sells shipping, packing and industrial supplies. We recommend trade credit with them all the time.

They even offer a lot of what Tier 3 vendors like Summa Office Supplies offer, but are easier for small businesses to get approval for.

They report to both Dun & Bradstreet and Experian. Before you can get approval for net terms, you MUST create an account with them. They will offer a small business net 30 terms.

Their qualification requirements include:

- Being an entity in good standing with Secretary of State

- An EIN

- A business address (matching everywhere)

- D-U-N-S number

- Business bank account

- Business phone number listed in 411

- A D&B PAYDEX score of 80 or better (although if you meet the other requirements you may get approval anyway)

Their credit department may require a few prepaid orders before extending net terms. A small business owner will need to create an account first, and then place an order and select Net 30 terms. Their Credit Department will review the account.

An application may be approved for a net 30 account at time of order. Upon final review, their Credit Department may change to a few pre-paid orders, before a net 30 is granted. You can also read our full Uline net 30 review.

4. FairFigure

FairFigure is a business credit monitoring tool that offers two tradelines. They report your monthly subscription payments as a vendor tradeline to the business credit bureaus, and they also offer a business credit builder card to all customers. The card reports to business credit bureaus as a financial tradeline.

Any business that pays qualifies for the vendor tradeline reporting. It’s $30 per month. New businesses and low revenue are accepted.

The FairFigure business credit monitoring service gives you access to your business credit reports and scores from Equifax Commercial, Creditsafe, and their own inhouse business credit report, the Foundation report.

To qualify for the FairFigure Capital Card, you need:

- An EIN number

- At least 3 months in business

- $2,500 in bank account deposits

FairFigure’s business card isn’t just a credit building card, it also provides a credit line based on your business’s revenue. The higher your revenue, the more you’ll qualify for.

Both the vendor tradeline and the financial tradeline report to: Equifax Commercial, Creditsafe, and the SBFE. Remember that the SBFE furnishes credit data to D&B and Experian Business, too.

5. Home Depot Pro

Our next net 30 account was once known as Barnett. There is no personal guarantee required to qualify.

As part of the Home Depot family, they offer facility maintenance supplies. This vendor will not accept virtual addresses. They report to Experian, and offer a small business net 30 terms.

Qualification requirements include:

- Being an entity in good standing with Secretary of State

- An EIN

- Business address (matching everywhere)

- D-U-N-S number

- Business license (if applicable)

- A business bank account

- Trade and/or bank references

There is a one year time in business requirement. For approval, a small business will have to have other approved vendors with a credit limit of $5,000 or higher.

Apply online. You will need to fill-up the credit application form and send that via email to: [email protected]

Or you can fax your application: 800.436.9192, or apply over the phone.

6. Pilot Flying J

Our next vendor credit account is Pilot Flying J. This trade credit is not a net 30 account.

This is a fleet credit account where you can earn up to four points per gallon (with limited time specials to earn up to five points per gallon). Get 24 hour approval for their Axle Fuel Card.

You can get credit, maintenance, or even trucking factoring. They even have fast-charging EV stations available at 500 of their locations.

Their qualification requirements include:

- Being an entity in good standing with Secretary of State

- An EIN

- Business address (matching everywhere)

- D-U-N-S number

- Business license (if applicable)

- A business bank account

- Your business’s most recent bank statement

Note that truckers and diesel accounts require a DOT Registration. Your business must have a DOT number or lease or contract agreement from the company that you will be leasing the authority from.

You can apply online or over the phone.

Note: their terms are Net 1. There is no personal guarantee required.

7. Brex

Our next Tier 1 account is Brex. This vendor account offers more than one small business credit card. But in this post we will only concern ourselves with the credit card which is paid daily.

In order to qualify, your business must have professional Investors like venture capital backing or private equity.

This business card reports to D&B, Experian business, and the Equifax business credit bureau.

They don’t offer balance transfers from another credit card to Brex due to not requiring a personal guarantee. They will allow balance transfers within Brex credit accounts only.

Brex offers rewards points that can be redeemed towards payment credit. Use Brex points to purchase hotels and flights through their internal travel portal or transfer Brex points towards air miles with some participating airlines.

For companies of any size, there is no minimum balance necessary. The card is paid daily from money deposited on your Brex Cash account balance.

Their qualification requirements include:

- Being an entity in good standing with Secretary of State

- An EIN

- Business address (matching everywhere)

- D-U-N-S number

- Business license (if applicable)

- A business bank account

- Providing or having plans to provide services and products to US customers

- Employing or contracting, or having plans to employ or contract US personnel

8. Creative Analytics

Our next net 30 account is Creative Analytics. They report to Credit Safe and Equifax Business. They are a digital marketing agency and management consulting firm.

Account holders with monthly subscriptions will get monthly revolving accounts with a credit line of up to $10,000 reported. There is a $79 fee to apply. This is refunded if the application is denied.

Plus there is a $100 minimum purchase to be reported for the first month (a little more than for Summa Office Supplies which is no longer a Tier 1 vendor). Then after that, there’s no minimum purchase to report. The annual fee counts toward that minimum.

They report to Credit Safe and Equifax on the last business day of the month.

Their qualification requirements include:

- Being an entity in good standing with Secretary of State

- An EIN

- Business address (matching everywhere; particularly the address listed with D&B should match Secretary of State and IRS records)

- D-U-N-S number

- Business license (if applicable)

- A business bank account

- Time in business of at least 30 days

- A business Phone Number Listed in 411

- No derogatory business reporting or delinquencies

- Payment of a yearly membership fee of $79

You can read our full Creative Analytics net 30 review here.

9. Credit Strong

Our last Tier 1 account is Credit Strong, a division of Austin Capital Bank. This vendor will report to Equifax business only. This is not a net 30 account or other net account. It is more of a combination of an installment business loan and a savings account.

No personal guarantee is necessary. There is no hard pull on your personal credit.

Their qualification requirements include:

- Being an entity in good standing with Secretary of State

- An EIN

- Business address (matching everywhere)

- D-U-N-S number

- Business license (if applicable)

- A business bank account

- Time in business of at least three months

- Small business entity must be an LLC, partnership or corporation

Apply online. Payment terms are that this is a loan and not a net 30 vendor account.

Their products can also help a small business owner build and improve their personal credit. This includes CS Max, which will report up to $25,000 of installment credit to the three major personal credit bureaus.

This means, for example, Equifax personal and not the Equifax credit bureau.

What Are the First Steps?

Of course, It does you no good to have a team if you don’t have a score board or even a field to play on. So, you have to complete the first two steps to start. Step 1 is to build a Fundable Foundation™.

This is how net 30 account credit providers will see that your business is legitimate and separate from you as the owner.

Here is a quick summary some of the things included in a Fundable Foundation™:

- Physical address where you can receive mail

- Toll free phone number listed in the 411 directories

- EIN (Employer Identification Number)

- Incorporating as an S-corp, LLC, or corporation

- Dedicated business bank account

- Proper licensing

- Business website

After that, you have to build business credit reports, which includes getting a D-U-N-S number from Dun & Bradstreet and making sure you are listed with the other business credit reporting agencies. Obviously, you cannot have a business credit score without a business credit report for vendors to report payments to. Establishing this “scoreboard” is Step 2.

Tier 1 Business Credit Vendors

This is the step where you actually start building your business credit. To win the game, you have to choose the right vendors for your team. Without building business credit, it is going to be hard to recruit. You have to go after the right ones for this stage.

These are vendors in tier 1, also known as starter vendors.

These vendors lay the groundwork for building a business credit score. They can provide an initial net 30 account that reports so that you can get a business credit score on the board.

Just like a winning team is a powerful recruiting tool in football, an initial business credit score opens the possibility of approval for advanced vendor credit accounts.

What Makes a Vendor a Tier 1 Business Credit Vendor?

These are usually companies that do not specialize in extending credit. Rather, they are retail businesses that may extend net 30 terms (or similar terms) on invoices to their customers as a courtesy.

Usually they offer either 30, 60, 90 days or however many days the net terms state, to pay in full.

It’s different from a credit card because it is not revolving credit, and there is no card. They extend this type of credit to customers without depending as heavily on creditworthiness as other vendors do.

That’s not to say they just give net 30 terms to anyone. They will just take factors other than commercial credit into account when determining creditworthiness.

With many of them, if you complete step one and build a strong Fundable Foundation™, you are likely to get approval.

Other Factors to Determine Creditworthiness

These vary from vendor to vendor, but some examples include:

- Previous or current relationship with the customer

- Time in business

- Average balance in business bank account

- Credit history

- And more

The Importance of Reporting

Vendors that extend net 30 terms (and other terms) without relying solely on business credit reports are hard enough to find.

However, to be a true tier 1 business credit vendor, they also have to report positive payment history to the business credit reporting agencies. Establishing a positive credit history is crucial for business credit building.

Many vendors will report negative payment experiences, but they will not report on-time payments. Unfortunately, this is the case with more than nine out of every ten vendors.

As you can imagine, this is a huge problem when it comes to building business credit. You need credit to get credit, and starter vendors that report are the only way to break the cycle. Yet, they are almost impossible to find on your own.

Using Tier 1 Business Credit to Prepare for the Future

Consider the following example:

A business ships items to customers on a daily basis. In fact, shipping expenses make up a significant portion of business costs.

A vendor account with Uline can allow you to stock up on shipping and packing supplies now, before prices get any higher due to continuing inflation. Then, you will be able to avoid raising shipping costs for your customers for a longer period of time.

In addition, it’s no secret that supply chain problems are plaguing just about everyone right now. It’s going to get worse before it gets better.

Vendor credit will allow you to place orders for things now, in anticipation of the fact that it may take a bit for them to come in. And building a robust credit history now can only help you later.

The Quickest Way to a Touchdown

Once you have a number of tier 1 business credit vendors reporting, you will be able to move on to more advanced vendors and to financing like a credit line. This will allow your business to always have access to the funds it needs to grow.

That’s definitely worthy of major points.

Business credit goes beyond Tier 1. Check out the next articles in our “Tiered Business Credit” article series:

- Tier 2 Business Credit Vendors – Your Next Level Up

- Tier 3 Business Credit Vendors in 2023 (This List May Surprise You)

- Tier 4 Business Credit Vendors – Time for Serious Funding

Here’s the next article.